Payments anytime, anywhere

Tyro BYO App`

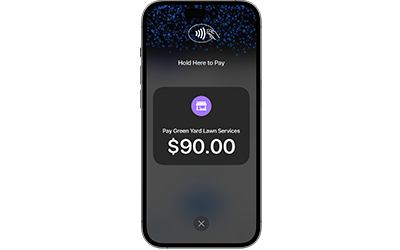

Take payments straight from your iPhone

WiFi and mobile networks via your iPhone

Contactless payments

Digital receipts

- check No extra hardware required

- check Easy, secure and private

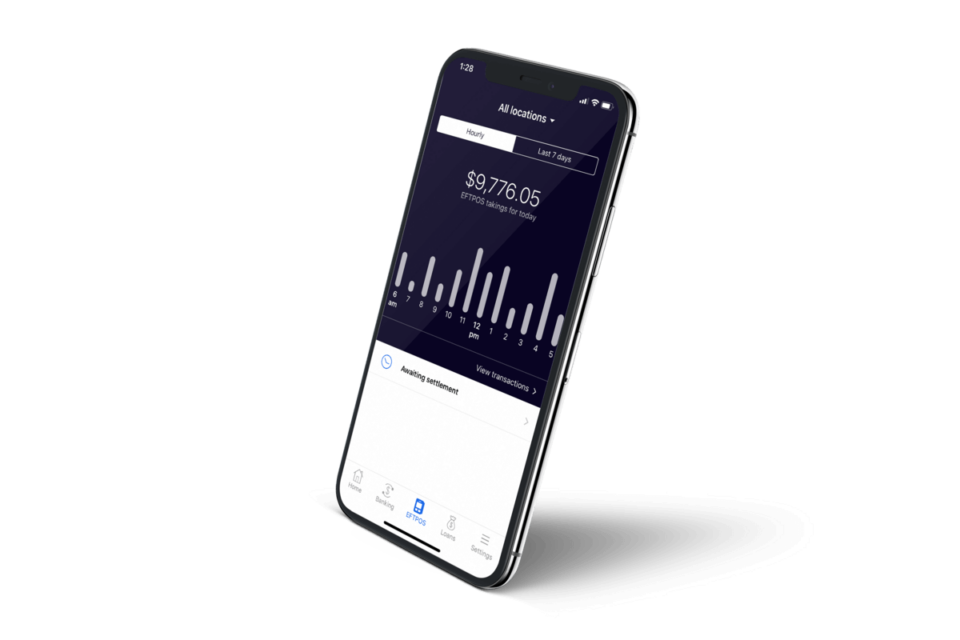

- check Access real time transaction reports

Take your business on the go

Tyro Go

Designed for businesses on the go

Internet-enabled smart device via Bluetooth info

Standalone payments via the free Tyro Go App

Flat price for easy budgeting

- check 8 hours battery life of continuous payments

- check Built in security measures for PIN entry

- check Branded digital receipts

Fast countertop transactions

CounterTop EFTPOS

Built for a fixed location

Ethernet with 3G backup

Integrated with 330+ POS/PMS systems

Reduce costs with surcharging and least-cost routing

- check Power adapter for continuous connection

- check Secure payments with PIN shield protection

- check Medicare EasyClaim and Health Fund Claiming info

Take payments to your customers

Mobile EFTPOS

Made for businesses that need flexibility

WiFi with 3G/4G backup

Integrated with 330+ POS/PMS systems

Reduce costs with surcharging and least-cost routing

- check Rechargeable with up to 8 hours battery life

- check Secure payments with PIN shield protection

- check Pay@Table, SplitBills, & BarTabs for your hospitality business info