Discover which EFTPOS solution is right for you

$29

machine rental

1.4%

transaction fee

$0

machine rental 1

$0

monthly bills 2

Transacting over $20K monthly in card payments?

We can provide customised pricing for your business.

No Cost EFTPOS is a surcharging pricing plan for customers who transact +$10k monthly. 2

$39

per device (incl. GST)

1.4%

per transaction (incl. GST)

Transacting over $20K monthly in card payments?

We can provide customised pricing for your business.

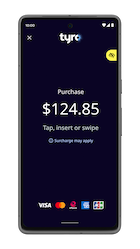

Let us make a recommendation or compare our range of EFTPOS solutions to see what’s right for your business.

With Tyro, you’re never locked in and you’ll never have to worry about any hidden fees or charges.

No monthly fees or long term commitments.

Signing up is easy and free.

Avoid any nasty surprises if you decide to leave Tyro.

“We found the feature and activation very simple. It’s very easy to update and it’s helped us recoup some of our fees across our eight locations.”

Fletcher Kidd, owner of Just Cuts Hunter

Reduce your payment fees for Tap & Go debit card transactions. Tap and Save is a great feature that offers your business least-cost routing to automatically find lower cost ways for you to process eligible Tap & Go debit card transactions through the cheapest network. 4

Find out how Tyro’s payment solutions can help your business thrive.

Find useful information on all of our products.

Combining online payments with your EFTPOS can streamline your business and that’s just the beginning.

Learn more about finding an EFTPOS solution that suits your business needs.

Australian-based 24/7 support