Your one stop shop for payments

POS integrated EFTPOS and eCommerce that keeps the checkout moving fast.

POS integrated EFTPOS and eCommerce that keeps the checkout moving fast.

Taking even a moment away from a customer could cost you a sale. With Tyro on your team, you can seamlessly integrate your POS and enjoy making EFTPOS transactions in seconds.

Tyro seamlessly connects to 450+ integrated POS/PMS providers.

Serve customers with fast transaction speeds

Support for Ethernet and WiFi with 4G backup on Tyro Pro EFTPOS.

Get 7-day Aussie-based customer support for EFTPOS and online payments.

Tap & Save (least-cost routing) could save you money by reducing the cost to acquire on debit contactless transactions 1.

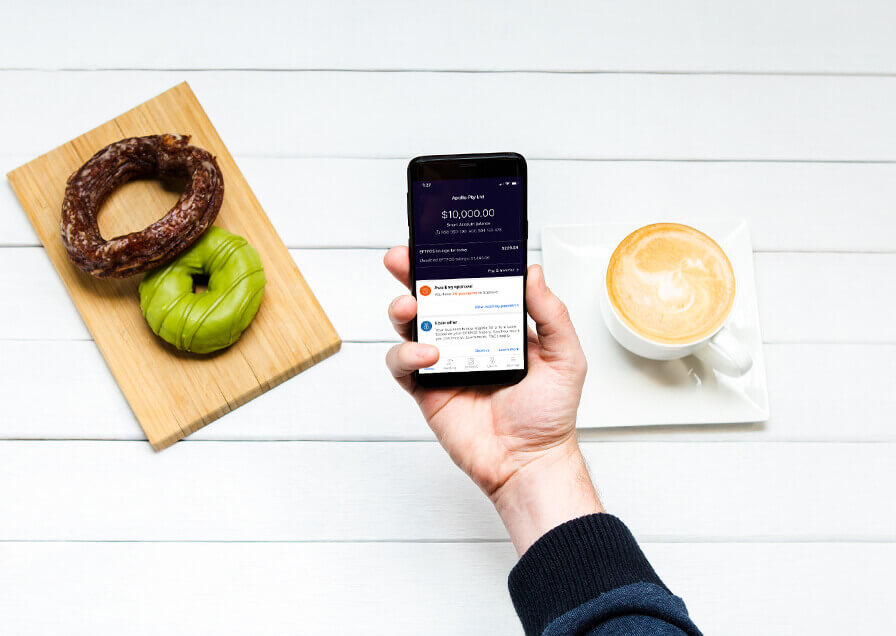

Monitor your EFTPOS takings in real time with the Tyro Portal and Tyro App.

Experience the future of payments with a next-generation EFTPOS device. A sleek and modern EFTPOS machine designed to cater to your payment needs.

Take your business wherever you go 2 with a portable payment solution that fits in the palm of your hand.

Settle in-store and online with a single settlement via our Tyro eCommerce solution. 3

Let your customers pay the way they choose when you accept more payment types.

Reduce your payment fees for Tap & Go debit card transactions. Tap & Save 1 is a great feature that offers your business least-cost routing to automatically find lower cost ways for you to process eligible Tap & Go debit card transactions through the cheapest network.

Take your business further by connecting to a POS partner with Tyro.

Need support? No problem. Just give our team a call on 1300 00 TYRO (8976).

In combination with Tyro EFTPOS, run your online business more efficiently through a single merchant account and same-day settlements 4 into the fee-free Tyro Bank Account. Use a virtual terminal with online payments, send Payment Links, or integrate your web store with our payment gateway.

No matter where you are or what time zone you’re in, you can gain rapid insights into your business with the Tyro Portal or the Tyro App. Get live EFTPOS data so you know exactly how you’re performing from anywhere.

We’re all about function that fits your business. That’s why the technology we develop has your customer in mind. Find out how we go beyond payment innovations to bring more to your business.

Earn interest on your income and choose when your daily EFTPOS and eCommerce takings are paid 4 with a fee-free Tyro Bank Account.

Keep business moving with rapid access to a business loan when you need it. 5

Learn more. Do more for your business

Find useful information on all of our products.

Combining online payments with your EFTPOS can streamline your business and that’s just the beginning.

Learn more about finding an EFTPOS solution that suits your business needs.