Business Loans for Small Businesses

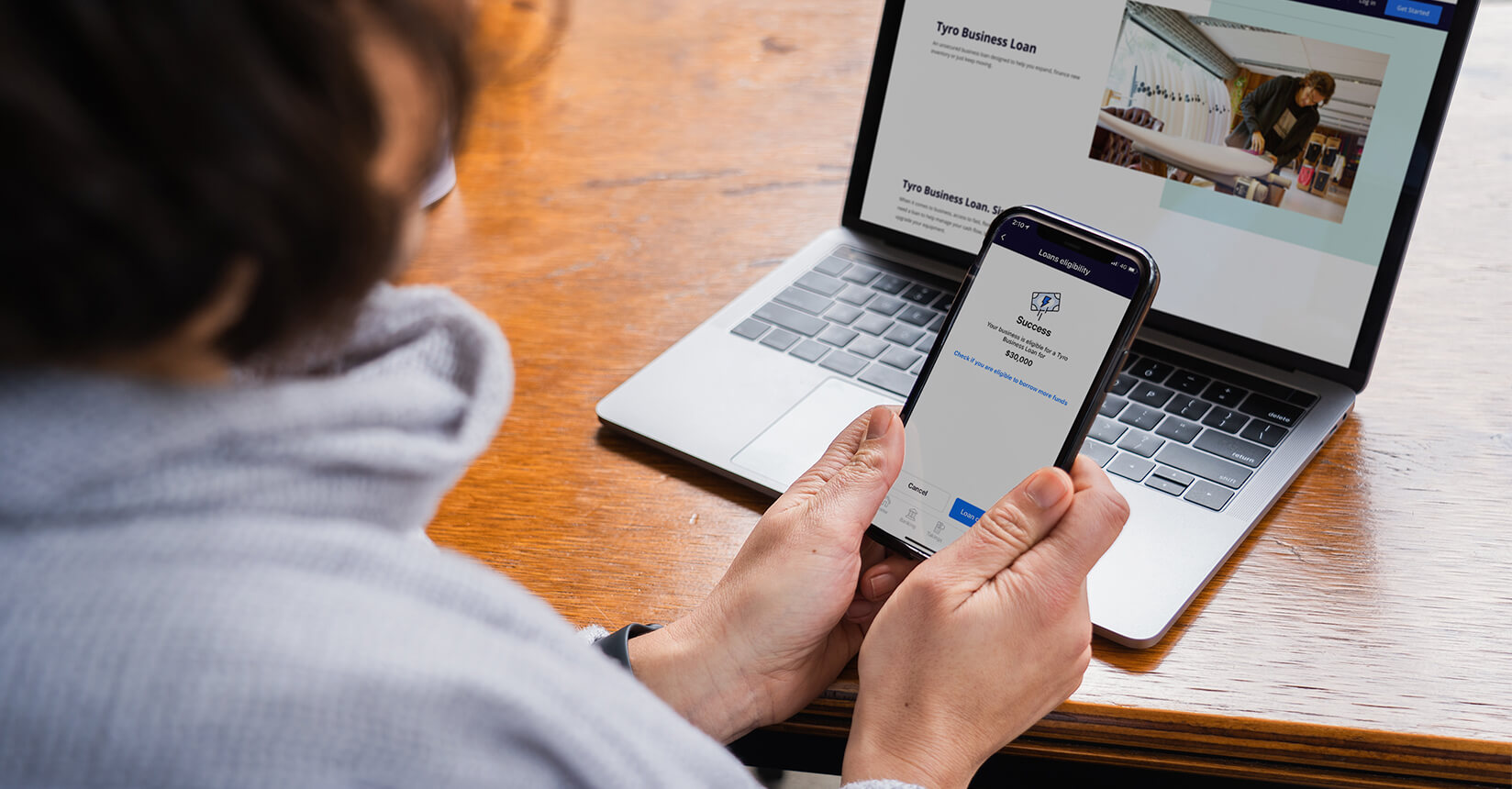

An unsecured business loan for Australian small businesses, designed to help you expand, finance new inventory, or keep your operations running smoothly. Apply today to access fast, flexible funding with no collateral required.

Available to Tyro EFTPOS and eCommerce customers with a Tyro Bank Account.

Get the help you need

Get the help you need