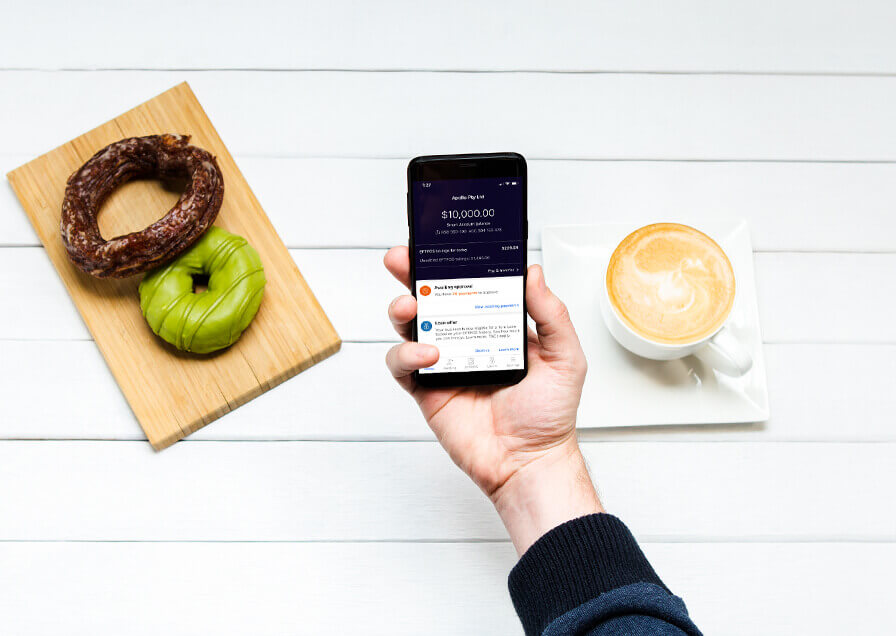

SEE YOUR MONEY SOONER WITH A NO FEE BUSINESS BANK ACCOUNT

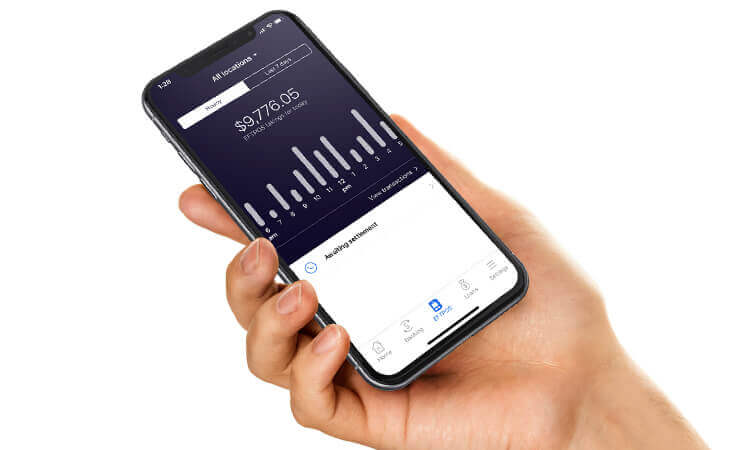

With a Tyro Bank Account your daily takings will be in your account the same day 1, so you can get paid 7 days a week. Even on weekends and public holidays.

Available to Tyro EFTPOS and eCommerce customers.

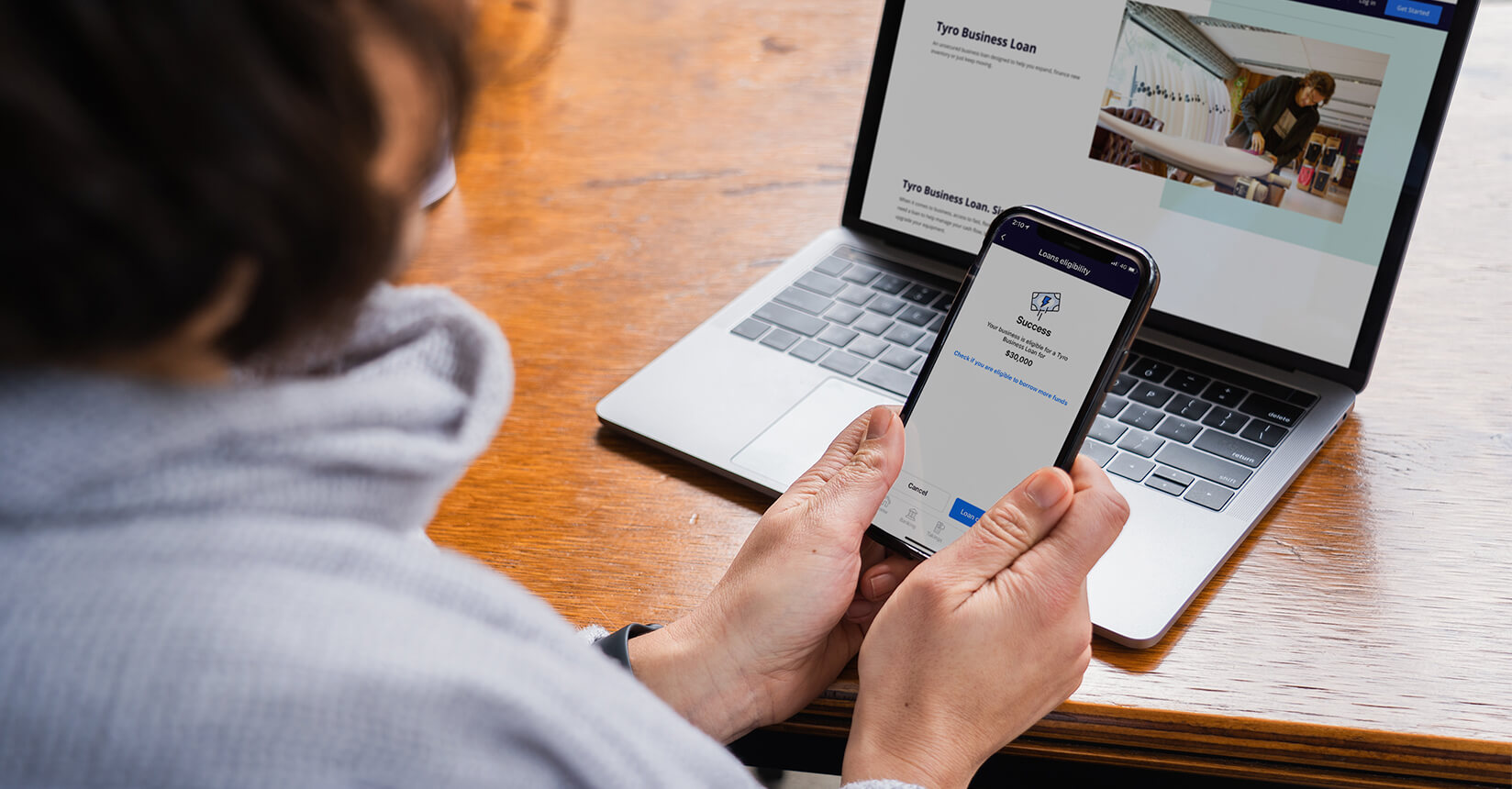

Get the help you need

Get the help you need