5 Reasons Tyro’s Enterprise Payment Solutions Are Built for Australian Businesses

In 2025, Australian SMEs continue to navigate a challenging economic landscape shaped by persistently high interest rates and inflationary pressures. Although the Reserve Bank of Australia (RBA) has implemented several interest rate cuts during the year, the official cash rate remains elevated around 3.6% *, keeping borrowing costs high for many businesses.

This environment creates ongoing pressure on cash flow and tight margins, especially for sectors such as hospitality, retail, and construction. Higher interest expenses make financing growth or everyday operations more expensive, contributing to increased insolvency risks in some industries.

Why are business loans such a challenge for Australian SMEs today?

Small and medium businesses in Australia face a uniquely tough loan environment in 2025. Despite SMEs accounting for around half of total business credit, recent surveys show one in five SMEs report difficulties obtaining finance *. The biggest hurdles include strict lender requirements, high interest rates, slow application processes, and collateral demands like personal or property assets.

Rising costs, delayed payments from clients, and tighter lending criteria intensify cash flow pressures, making access to traditional loans both difficult and risky. Many businesses need capital quickly but face weeks-long approvals, restricting their ability to pivot or seize growth opportunities amid uncertainty.

What makes Tyro Flexi Loans different?

Tyro Flexi Loans cut through these challenges by offering speed, simplicity, and transparency. Unlike traditional loans loaded with interest rates and endless paperwork, Tyro makes borrowing straightforward with a single fixed flat fee. This means borrowers can plan repayments with certainty and avoid escalating debt costs tied to variable rates.

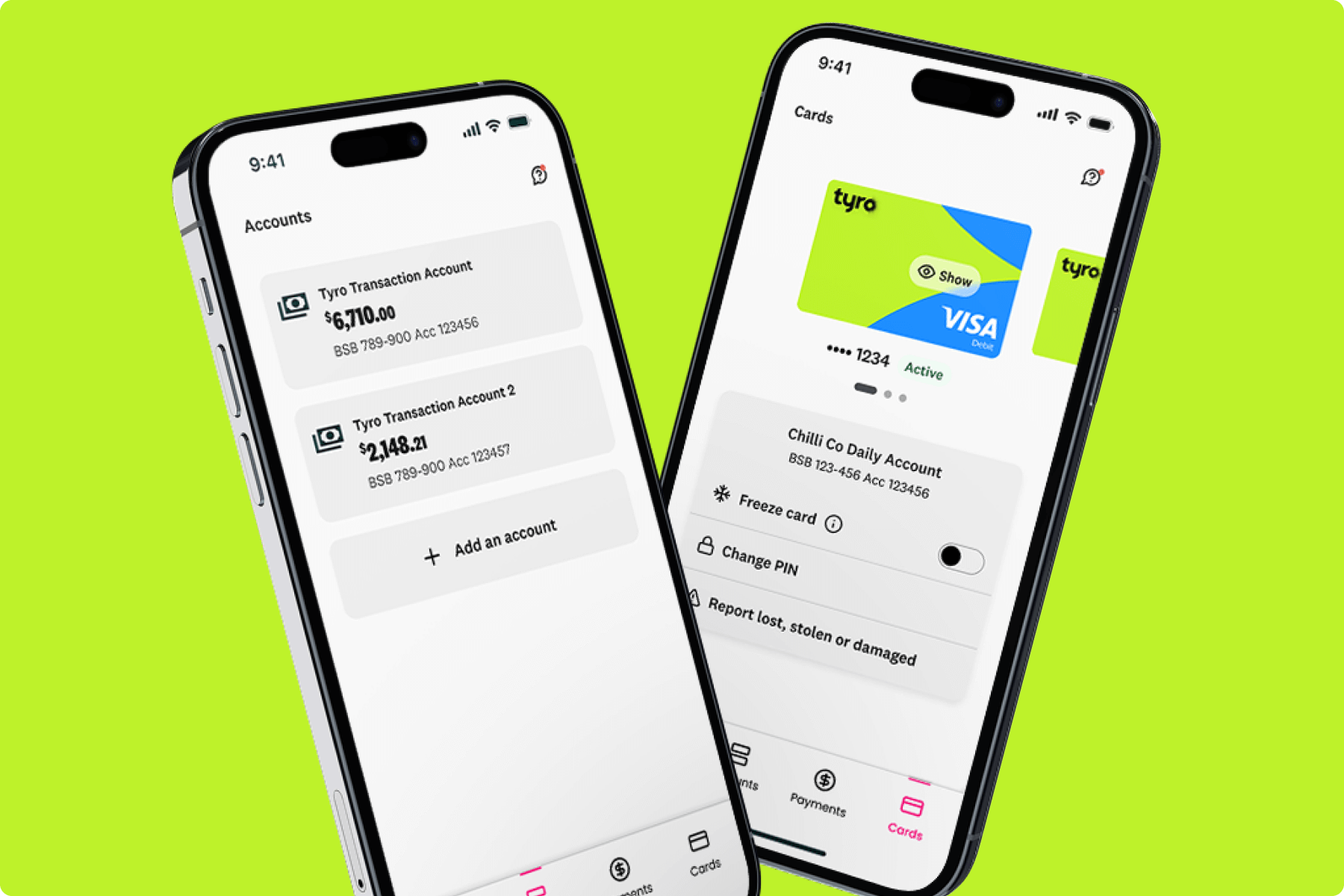

Eligible customers ^ can apply for Tyro Flexi loan via the Tyro Bank app or web portal, receive near-instant approval at the click of a button, and access funds in as little as 60 seconds – with no paperwork.

How Tyro Flexi Loans work: Fast, simple, and flexible funding

Tyro Flexi Loans are designed around the real-world cash flow of SMEs. Borrowers choose how much to borrow ^ – up to $350,000 ^ and nominate a percentage of daily takings to repay. As repayments automatically adjust with sales fluctuations, businesses avoid undue pressure during slow periods and pay more when trade is brisk.

This pay-as-you-earn model removes the stress of large, fixed repayments and makes managing cash flow easier. Everything from loan management to repayments is handled in the Tyro Bank App or Portal, providing full transparency, quick adjustments, and the freedom to pay down loans early without penalty.

Who can benefit most from Tyro Flexi Loans?

Tyro Flexi Loans are best suited to SMEs facing unpredictable cash flow or sudden working capital needs. Whether covering payroll during lean months, paying unexpected supplier costs, repairing or replacing equipment fast, or stocking up for busy seasons, these loans bridge critical funding gaps. By aligning repayments with actual revenue, Tyro Flexi Loans help businesses maintain agility and stability amid market volatility.

Ready to take control of your business cash flow?

For Australian SMEs, cash flow challenges and high borrowing costs no longer need to be a barrier to success. Tyro Flexi Loans provide a fast, flexible, and transparent alternative to traditional lending, designed specifically for the realities of small and medium businesses life today.

With just one simple flat fee, you get a clear path to funding that moves at the speed of your business. Check your eligibility today via the Tyro Bank App or Portal and experience how effortless bridging cash flow gaps can be.

Please note:

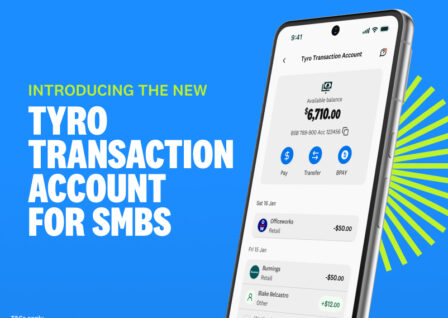

The Tyro Flexi Loan is available only to new customers with a Tyro Transaction Account. Existing Tyro Bank Account holders can contact our customer support team to find out how to switch to a Tyro Transaction Account.