How can we help?

$0 set up and account-keeping fees, with no minimum balance required.

Get your takings faster with same day settlement, 7 days a week. *

Request a Tyro Visa Debit Card to withdraw funds, or make payments online, in-store or over the phone.

Connect Tyro to Xero® or MYOB® for automated bank feeds that handle the admin for you.

Get easy access to the cash you need to take care of bills, order new stock, and cover everyday business expenses.

Get easy access to the cash you need to take care of bills, order new stock, and cover everyday business expenses.

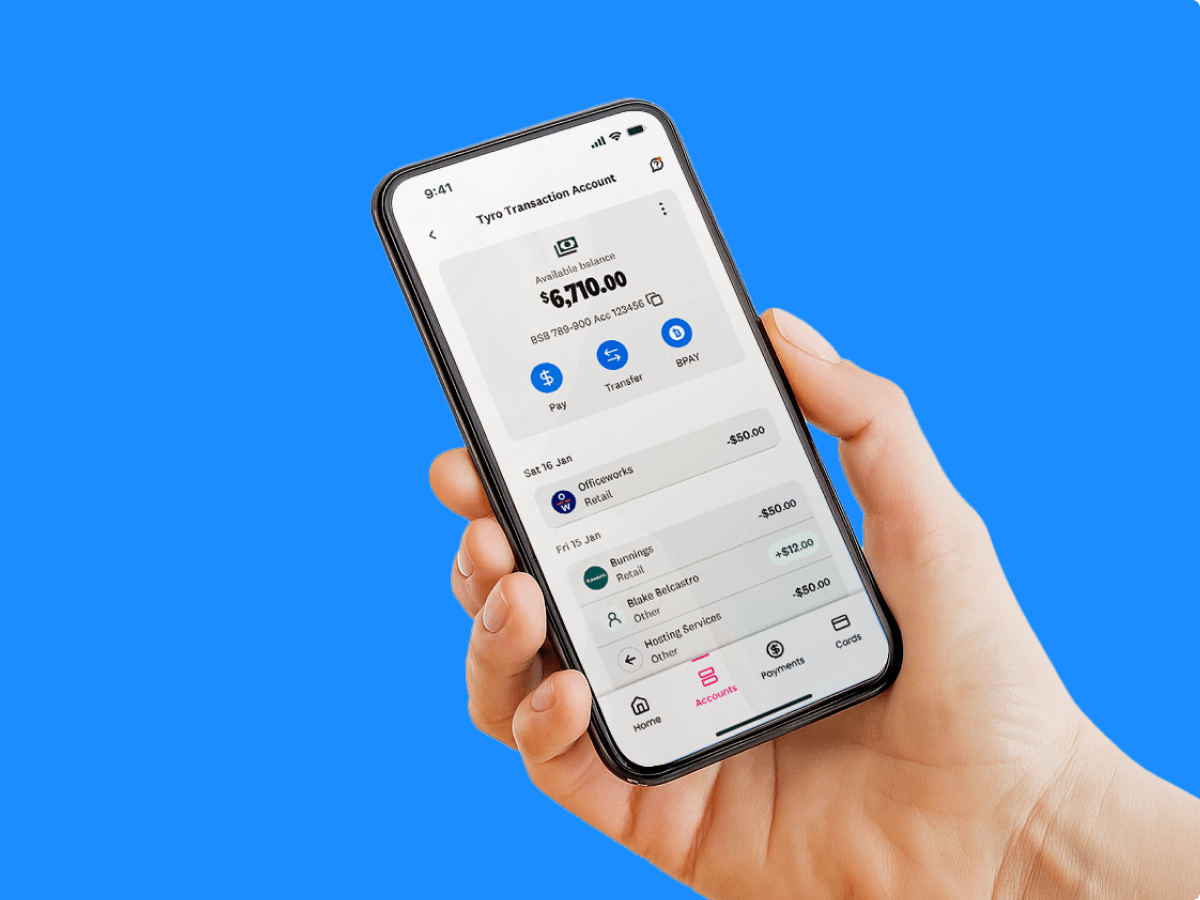

Same day settlements *, 7 days a week including public holidays.

Use PayID®, PayTo®, Osko®, BPAY®, bank transfer and direct debit to make payments fast and secure.

Manage your cash flow, track spending and allocate funds for different purposes.

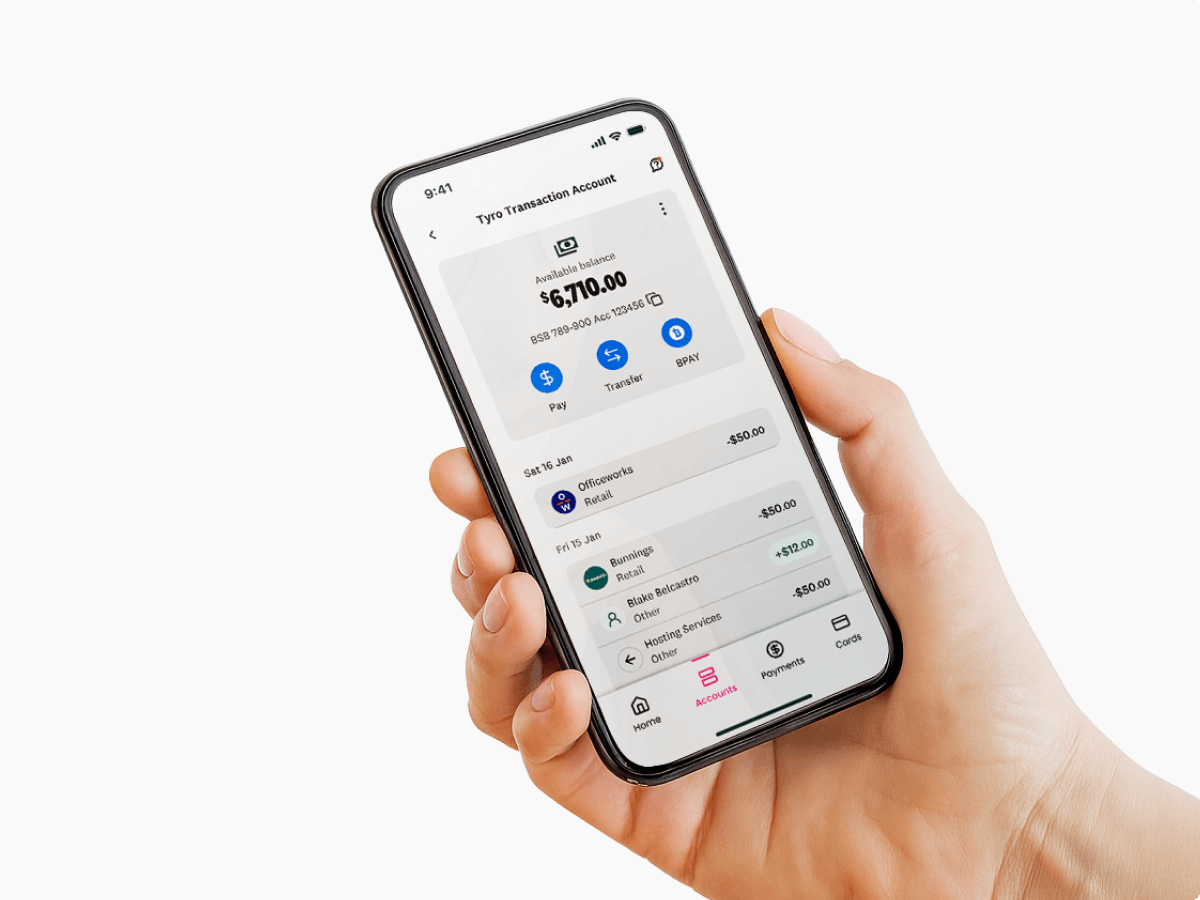

With our Transaction Accounts you get a free Tyro Visa Debit Card to use for ATM withdrawals, as well as contactless and online payments.

> Access your money fast to make payments online, instore and over the phone

> Manage card controls and limits via the Tyro Bank App

> Manage all your accounts in one place and easily view your businesses finances in real time

> Easily schedule reoccurring and batch payments to pay staff and other regular expenses

> Get in-app support 24/7, backed by people who genuinely understand small business

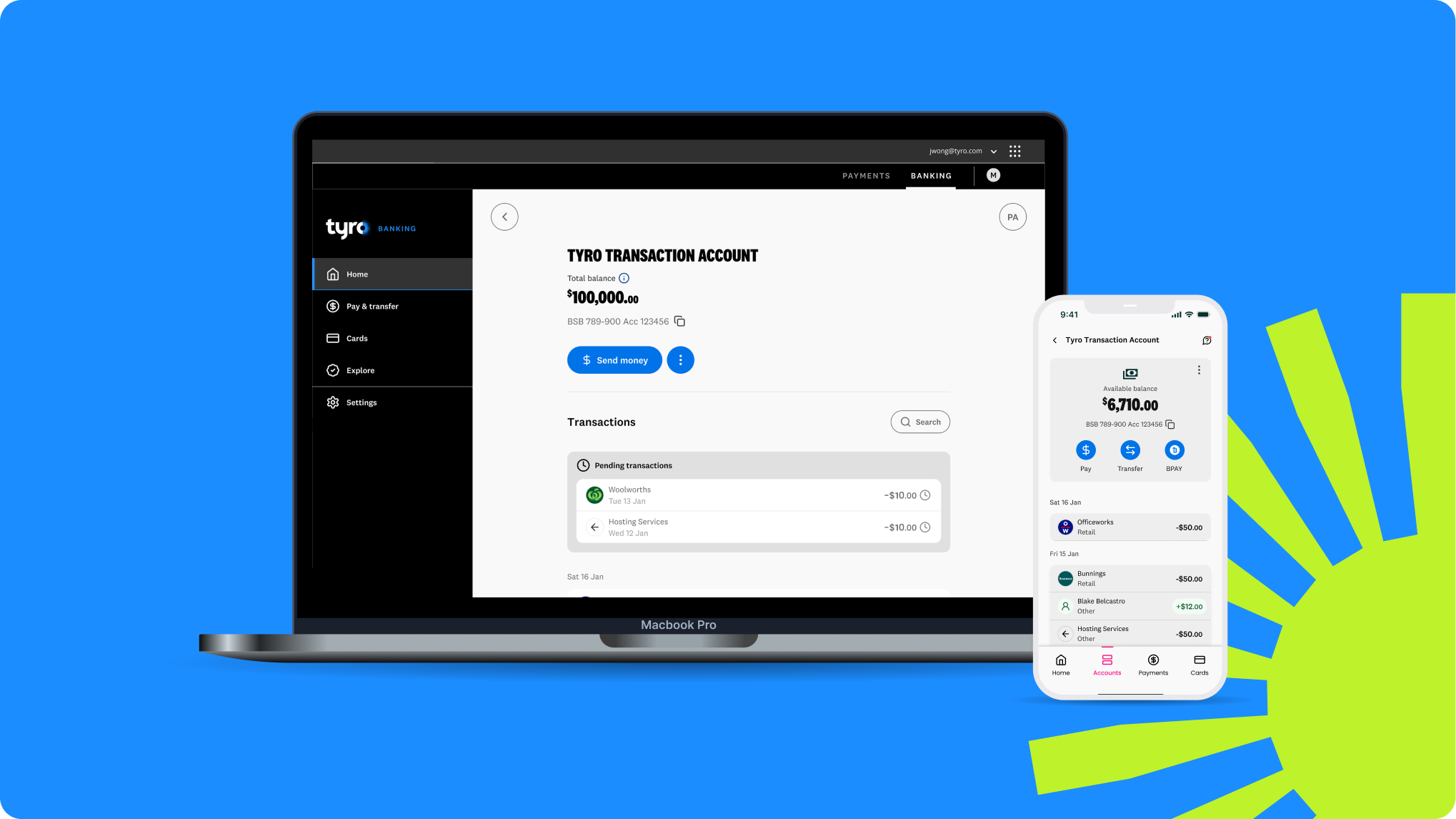

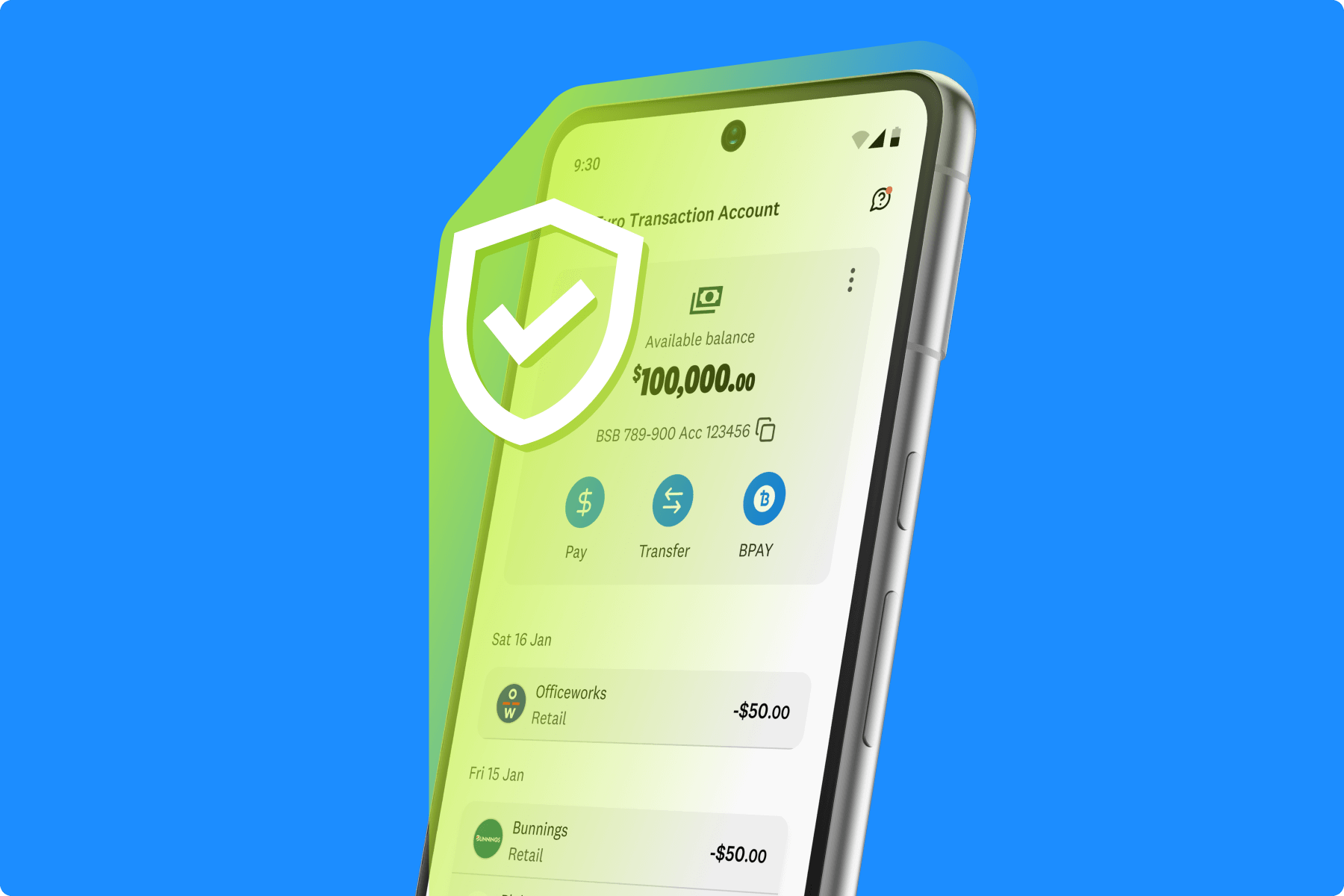

View and manage all your Tyro accounts in one secure place

> Schedule one-off or recurring payments with ease

> Access your funds, cards and loan options anytime

> Connect your account to Xero® or MYOB®. Once connected, your daily deposits, withdrawals and payments flow straight into your accounting software – so your books stay organised without any manual work.

> Deposits are protected under the Financial Claims Scheme up to $250,000 per account holder ^.

> 24/7 fraud detection and intervention with real-time issue resolution alerts.

> Advanced encryption and security measures to protect your financial data.

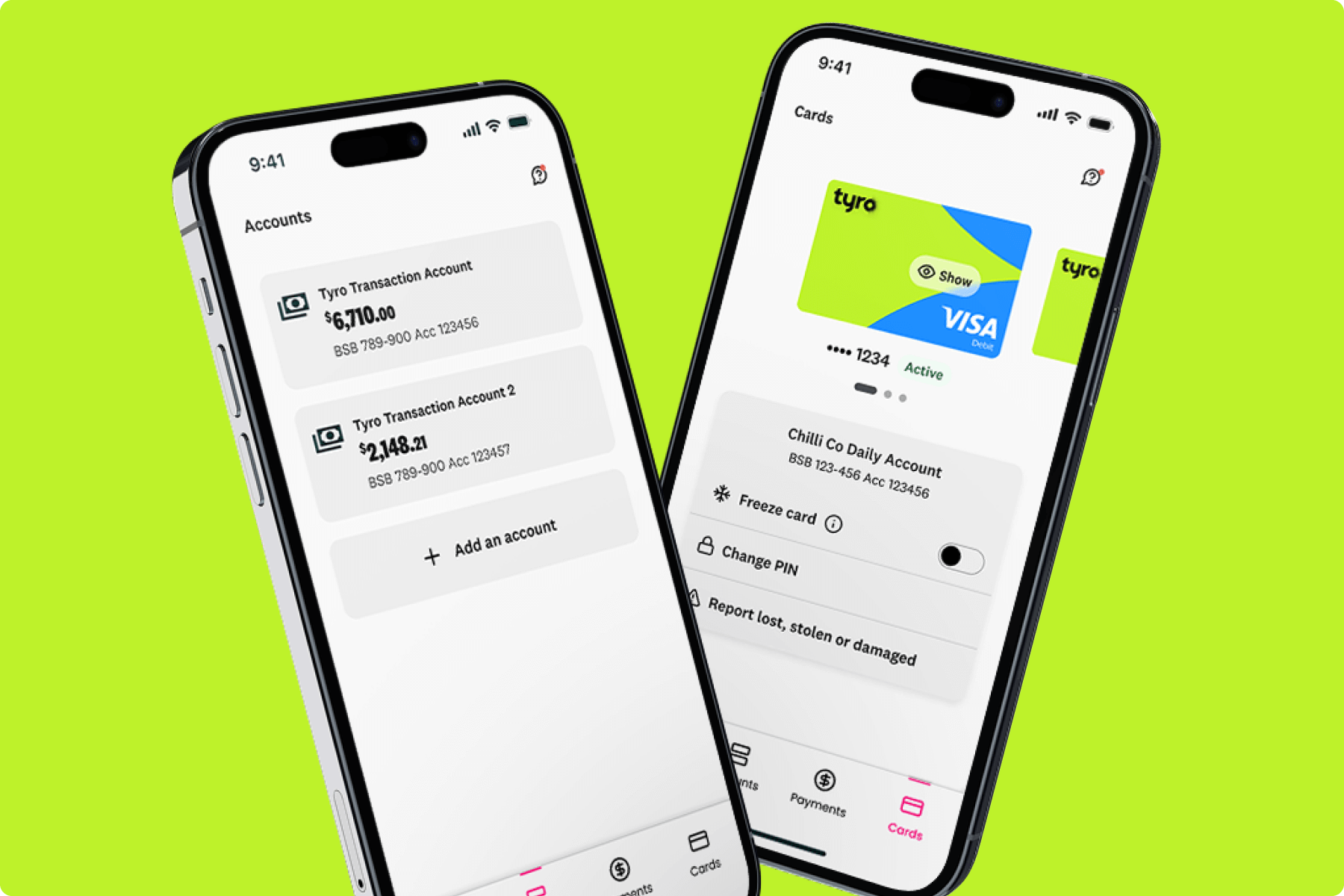

> Set controls, limit or freeze your Tyro Visa Debit Card in either the Tyro Bank App or Portal.

Customers new to Tyro can open a Tyro Transaction Account by applying online during onboarding. Eligible existing Tyro merchants who have not previously held a Tyro banking product can now apply for a Tyro Transaction Account directly through the Tyro App or Portal.

To open an online business bank account with Tyro, you need to be an existing Tyro payments customer, provide proof of business registration, identification, and address verification. These documents help us ensure the security and compliance of your account.

Yes, you can set up automatic transfers from your Tyro Transaction Account to an external account by accessing the online banking portal or the Tyro Bank App and following the prompts for setting up scheduled transfers. This allows for easy transfers and management of your business bank accounts and funds.

No, you don’t need to cancel your existing bank account to use the Tyro Transaction Account. However, the Tyro Transaction Account is fully featured to help you manage your cash flow from one place.

Tyro’s online business banking is highly secure, using advanced encryption and security measures to protect your financial data. Our systems are designed to provide a safe and reliable banking experience for your business. The Tyro Transaction Account has 24/7 fraud monitoring, detection and intervention.

Tyro is an excellent choice for small business banking because it has no account fees and offer a range of flexible features making it suitable as your everyday business bank account. You can effectively manage your cash flow with the ability to open multiple accounts for different purposes, open a linked Visa Debit Card and access a range of payment options, plus much more. Tyro also offers seamless and fast settlements from your Tyro product, providing an end-to-end payments and banking experience.

You can make payments in a variety of ways with a Tyro Transaction Account Bank including Pay ID ®, PayTo ®, Osko ®, BPAY ®, bank transfer and direct debit.

Simply log in to the Tyro Bank App or web portal and , navigate to the ‘Cards’ tab to view the accounts that you can request a debit card for. Follow the prompts to request a card for your chosen account. The card will be sent to your delivery address on record.

You can open additional Tyro Transaction Accounts by logging into the Tyro Bank App or banking web portal. On the ‘Home’ screen, scroll to the bottom, click ‘Add an account’ and follow the prompts to open another Tyro Transaction Account.

If you have multiple accounts open, your funds will automatically settle into the first account that you opened, with clear descriptions to help you easily track and manage your takings. You will be able to move funds between your other accounts manually or via scheduled transfers.