Get your business ready for 2026

24 November 2025 - 3 min read

Business Strategies

Every transaction tells a story about your business. When you’re processing thousands daily across multiple channels, those stories need to flow seamlessly- from checkout to reconciliation, from customer experience to compliance. Yet many enterprise leaders find themselves managing fragmented payment systems that create more complexity than clarity.

The question isn’t whether your payment infrastructure can handle today’s volume. It’s whether it can scale with tomorrow’s ambitions while giving you the visibility and control needed to make confident decisions.

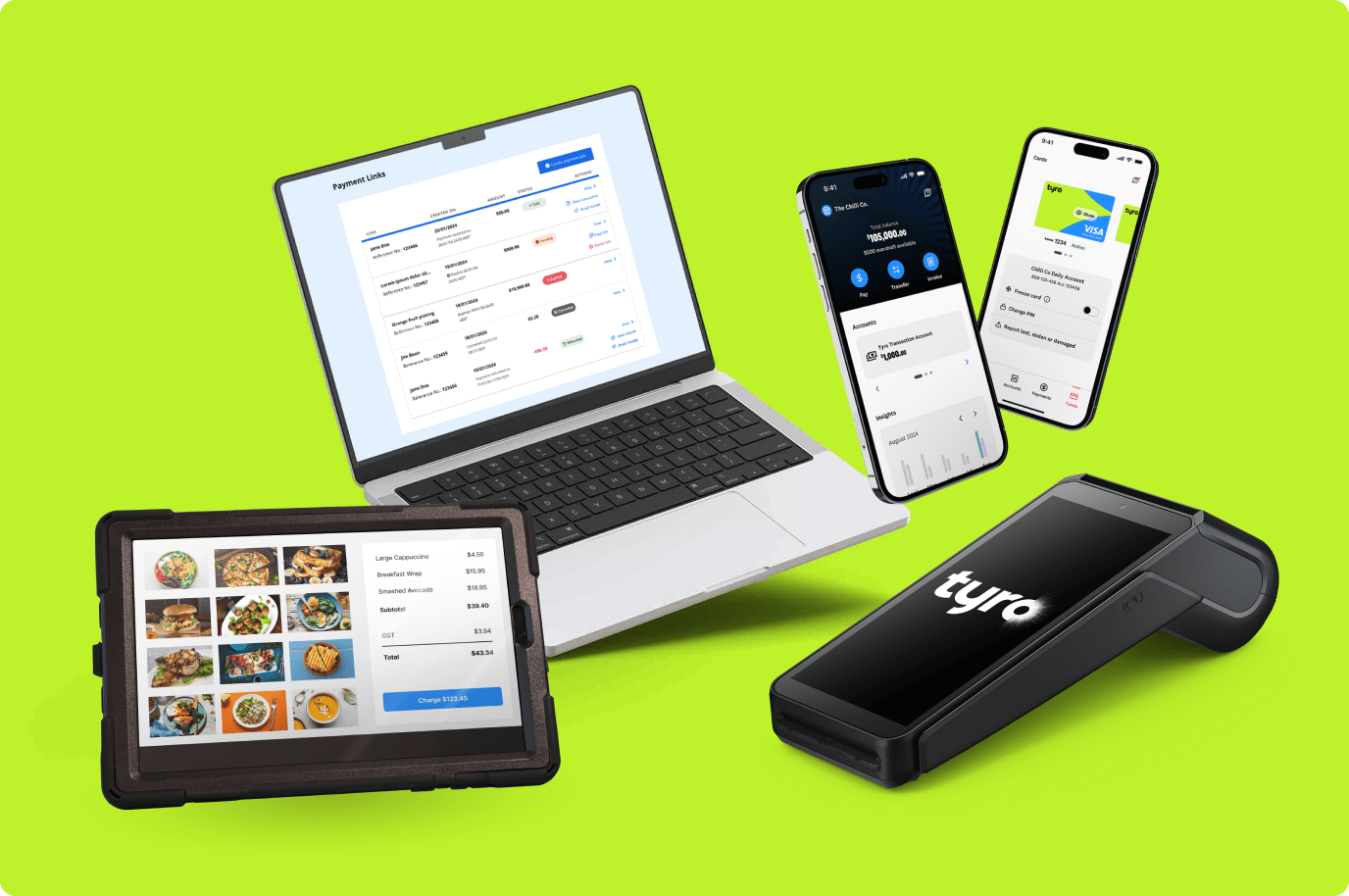

At Tyro, we don’t offer a standalone enterprise platform. Instead, we’ve built something more valuable for Australian businesses: an integrated payments ecosystem that connects directly with over 450+ Point of Sale (POS) systems, providing the APIs, Checkout solutions, and Payment Links * that enable your business to accept payments wherever transactions happen.

Whether your customers are paying in-person or online, Tyro acts as a single payments partner, unifying every touchpoint. This isn’t about replacing your existing systems – it’s about making them work better together.

Enterprise businesses don’t have simple payment needs. Your infrastructure must support everything from online checkouts and recurring subscriptions to digital invoicing and loyalty programs. Tyro’s flexible payment infrastructure handles it all:

In payments, downtime isn’t just inconvenient – it’s costly. Your payment infrastructure needs to perform consistently, especially during peak trading periods when revenue opportunities are highest.

Tyro delivers 99.99% uptime ^ backed by Australian-based support available seven days a week. We’re not just a provider; we’re your payments partner invested in your success:

Running multiple payment providers creates predictable problems: fragmented settlements, inconsistent reporting, limited visibility into performance. For enterprise leaders, this means more time reconciling data and less time driving strategic decisions.

Tyro brings every channel together under one unified view:

Your customers expect consistency across every touchpoint. Whether they’re checking out online or paying in-store, the experience should feel seamless, secure, and on-brand.

Tyro helps you deliver that seamless experience:

Every friction point removed is an opportunity to strengthen customer loyalty and increase lifetime value.

Whether you’re managing data across several locations, enabling payments through POS partners, or integrating payments into your software platform, Tyro provides the tools, local expertise, and reliability ^ to simplify operations at any scale.

One platform. One payments partner. Complete control across every channel.

The right payments infrastructure doesn’t just process transactions- it unlocks operational efficiency, reduces friction, and gives you the visibility to make better business decisions.

Connect with Tyro’s Enterprise team to explore how we can support your business goals.

21 Oct 2025 - 6 min read

20 Oct 2025 - 3 min read

3 Jun 2025 - 3 min read

Australian-based 24/7 support