How can we help?

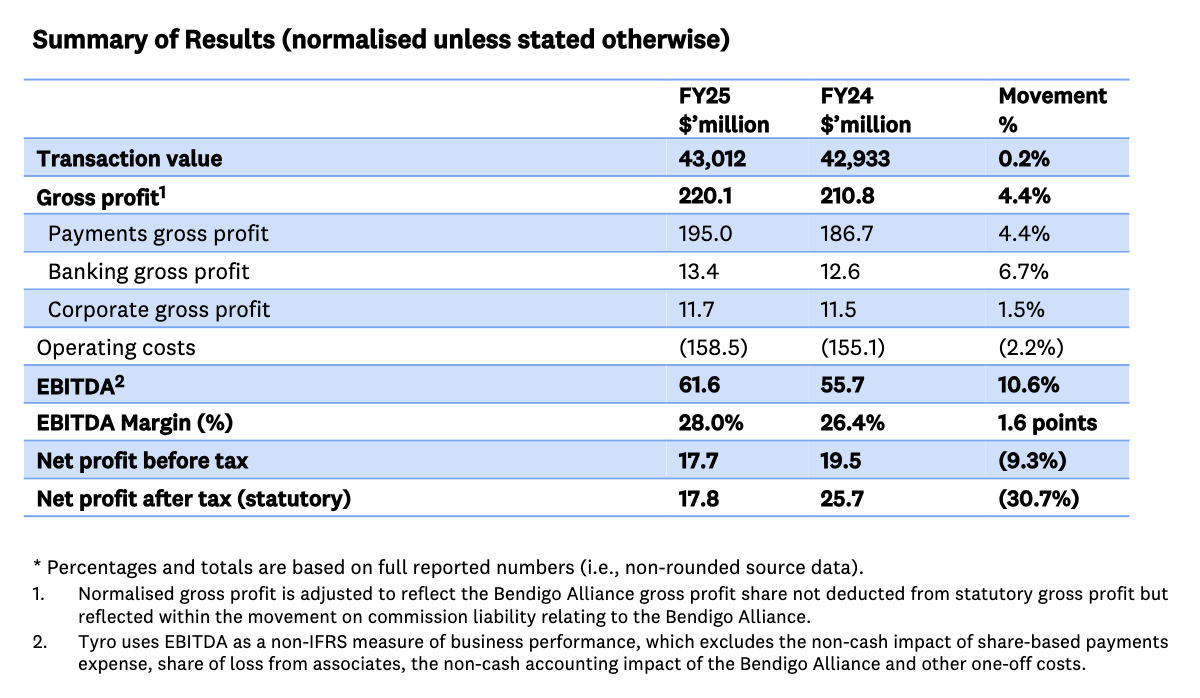

Tyro Payments Limited (Tyro or the Group) today announced its FY25 full year results, delivering in line with gross profit and EBITDA margin guidance and accelerating delivery of growth strategy initiatives.

Tyro CEO and Managing Director Jon Davey said: “This is a strong set of results, in line with guidance provided to the market. Our focus on sustainable and profitable growth in recent years is highlighted by a 14% gross profit compound annual growth rate, more than outstripping growth in expenses, and leading to a 79% EBITDA CAGR over the last three years.”

Tyro continued to enhance its customer value proposition with the delivery of key product and partner innovations. FY25 highlights included:

Jon Davey added: “In a highly competitive environment, our new product and partner solutions continue to enhance our customer value proposition and have contributed to a ~20% increase in transaction value from new merchants. Our new banking platform offers Tyro customers a market-leading small business cash flow management solution.”

Tyro continued to see strong merchant adoption of its banking products.

“Active banking users grew 43%, with one in three new merchants now opening a Tyro Bank Account. We are pleased with this uptake and see more opportunity for growth. Our new platform includes a fully-featured transaction account, debit card, term deposit, and flexi loan, making it easy for merchants to manage all their cashflow needs.”

Tyro expanded its market opportunity, announcing solutions in new industry sub-verticals.

“In FY25 we built the foundations that will see us launch into new underserved industries where we can create a strong competitive advantage. This includes pet insurance, aged care, unattended payments and automotive sales and servicing. Collectively, these new sub-verticals present an addressable market opportunity of more than $40 billion of payment volumes.”

Reporting strong results for FY25, Tyro is well positioned to accelerate delivery of its strategic priorities and unlock future growth.

“Our strong balance sheet and disciplined cost management provide the capacity to accelerate the delivery of our strategic initiatives, including inorganic growth, while continuing to deliver strong outcomes for our merchants and shareholders. While early in the year, we’re encouraged by the positive trends we are seeing in our payment volumes and adoption of our banking offering into Q1 FY26, which supports our FY26 outlook.”

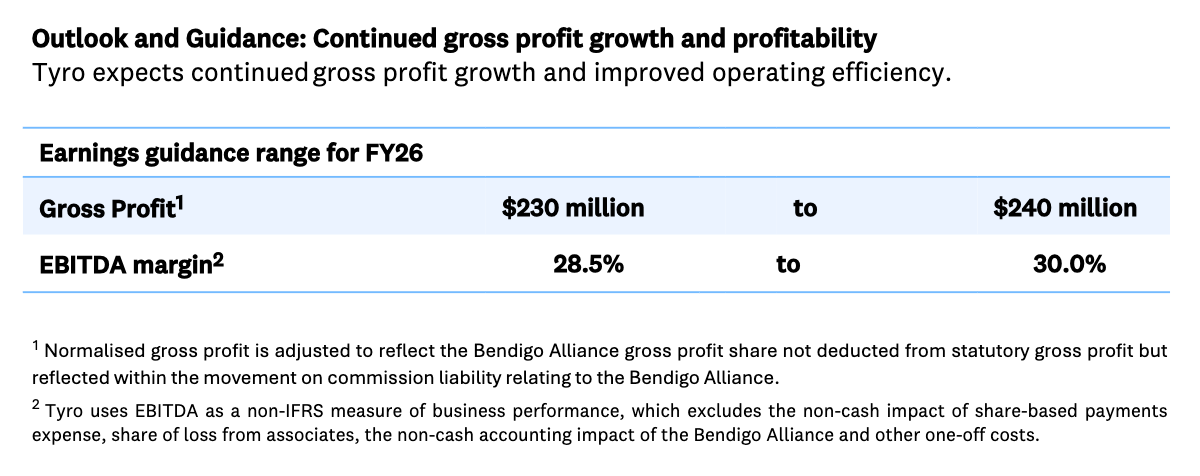

Tyro expects continued gross profit growth and improved operating efficiency.

For detailed commentary, please refer to Tyro’s FY25 Annual Report and FY25 Investor Presentation.

A briefing for investors, analysts and media will be held at 9:30am Australian Eastern Standard Time (AEST) today. The briefing will be hosted by Tyro CEO and Managing Director Jon Davey and CFO Emma Burke. Participants can register for this webinar here: FY25 Results Investor Presentation Registration. Registered participants will receive the details to the webinar upon registration. For more information, please contact:

Media

media@tyro.com

Investors

Martyn Adlam +61 452 112 621

investorrelations@tyro.com

Pursuant to Listing Rule 15.5, Tyro confirms this document has been authorised for release by its Board of Directors.

In 2003, Tyro set out to make payments the easiest part of doing business. Today, we’re still into business big time, powering more than 76,000 merchants across Australia with in-store, online and on-the-go payment solutions. Working with more than 450 POS partners, we create seamless payment experiences for hospitality, retail, services and health providers, with integrated banking and lending solutions designed to help unlock the potential of every business.

Forward-Looking Statements: Tyro’s financial expectations and guidance included in this announcement are subject to there being no material deterioration in market or macroeconomic conditions, and are based on a number of key assumptions which may not prove to be correct, or which may change over time, including no material changes to current business plan and no material change in the regulatory environment. During the ordinary course of business, the Group is exposed to credit risk, operational risk, market risk, macroeconomic risk and liquidity risk. For details on the management of these risks, please refer to the Annual Report including the Operating & Financial Review and the Financial Report for the year ended 30 June 2025. Certain statements contained in this announcement are forward-looking statements or statements about future matters, including indications and expectations of, and guidance and outlook on, the future earnings, financial position and/or performance of Tyro. These statements are based on information available as at the date of this announcement and involve known and unknown risks and uncertainties and other factors (many of which are beyond the control of Tyro). No representation is made or guarantee given that the occurrence of any of the events expressed or implied in these statements will actually occur. Actual future events may vary from these forward-looking statements and it is cautioned that undue reliance should not be placed on any forward-looking statements.

Australian-based 24/7 support