How can we help?

How Aussies are eating, drinking, and spending, and what this means for small businesses in 2026

37% use QR code ordering to avoid awkward money conversations

Up from 75% least year

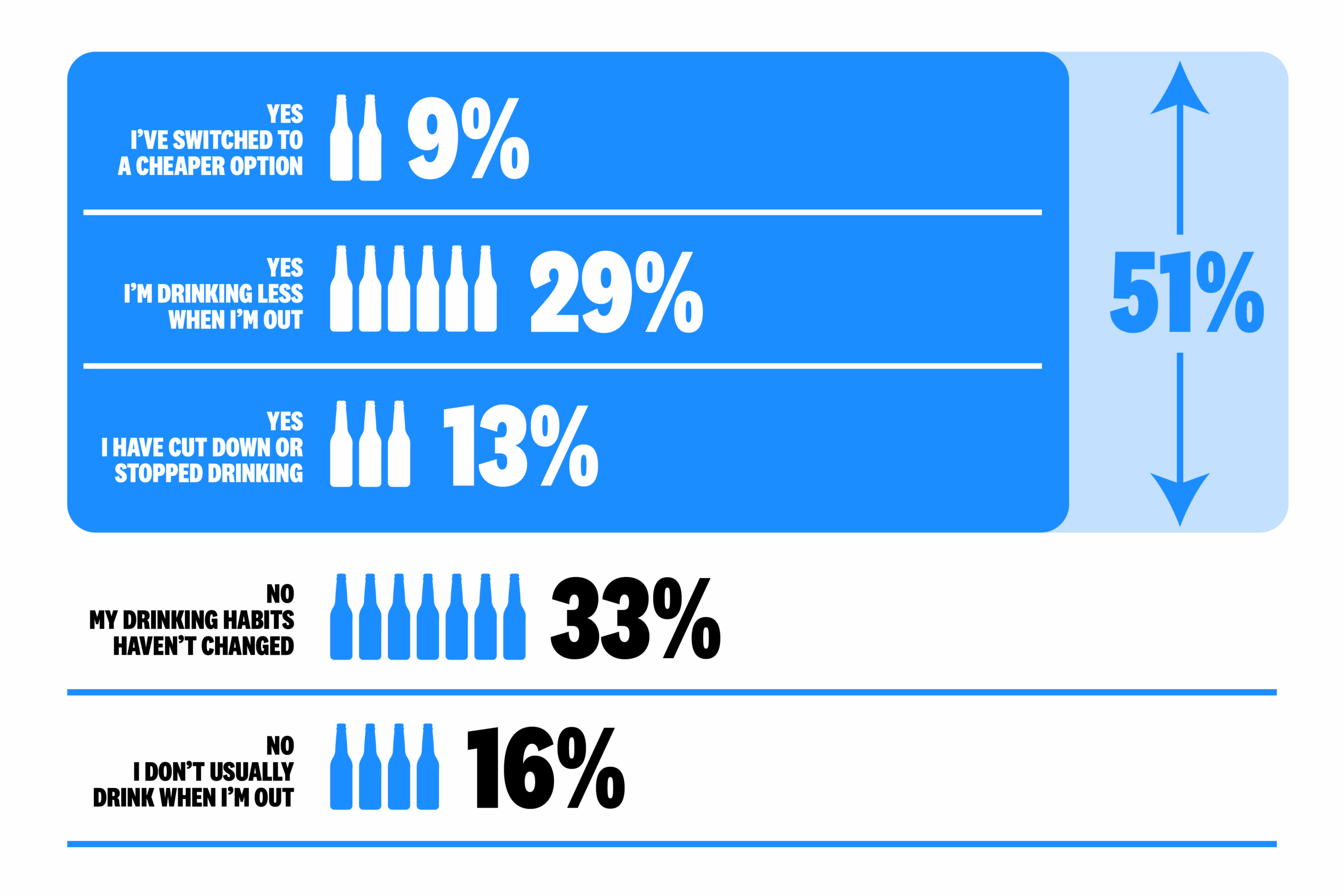

51% have changed their drinking habits due to cost pressures

Followed by reduced customer spending

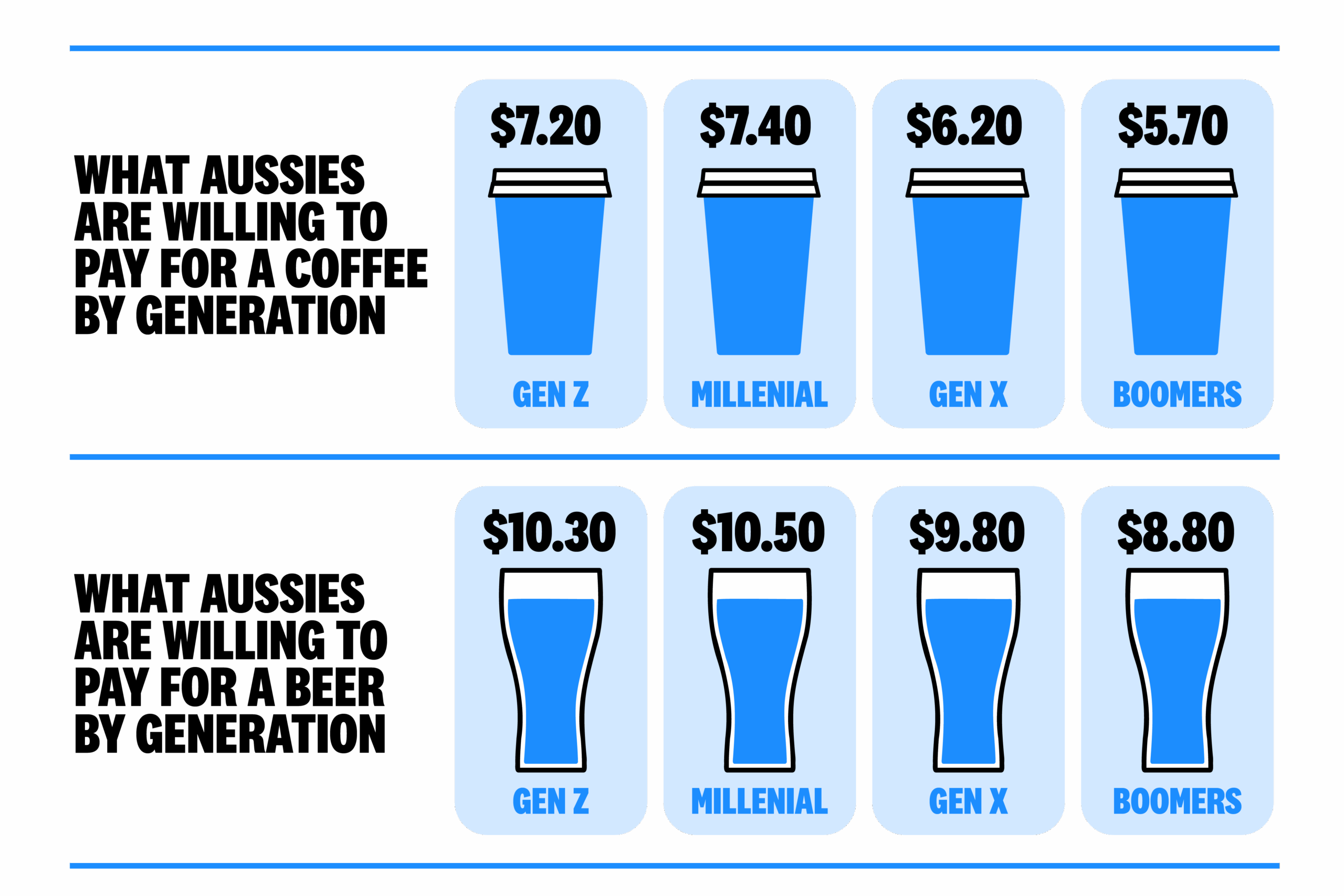

Gen Z and Millennials are willing to pay 23% more for coffee and 14% more for beer than Baby Boomers

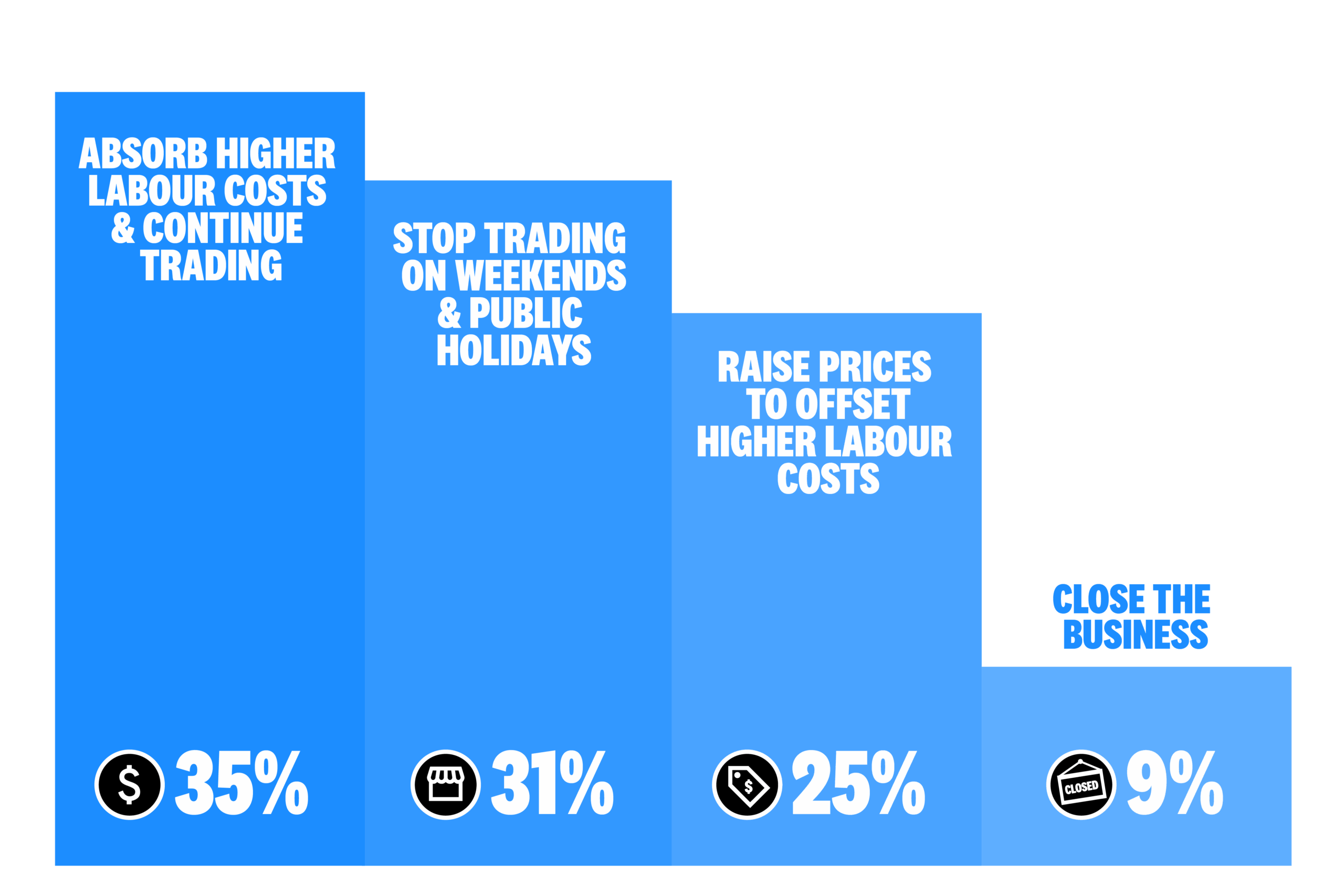

9% would close

Nearly three in ten (29%) are drinking less and almost one in ten (9%) are switching to cheaper options. A further 13% say they have cut down or stopped drinking alcohol altogether. Gen Z (18%) are most likely to have stopped drinking, followed by Millennials (14%).

The Aussie pub tradition of buying rounds is also losing ground as the cost of socialising rises. One in three (32%) say they are less likely to buy a round of drinks than they were a year ago. While Gen Z are more likely than older generations to shout, overall, the practice is on the out.

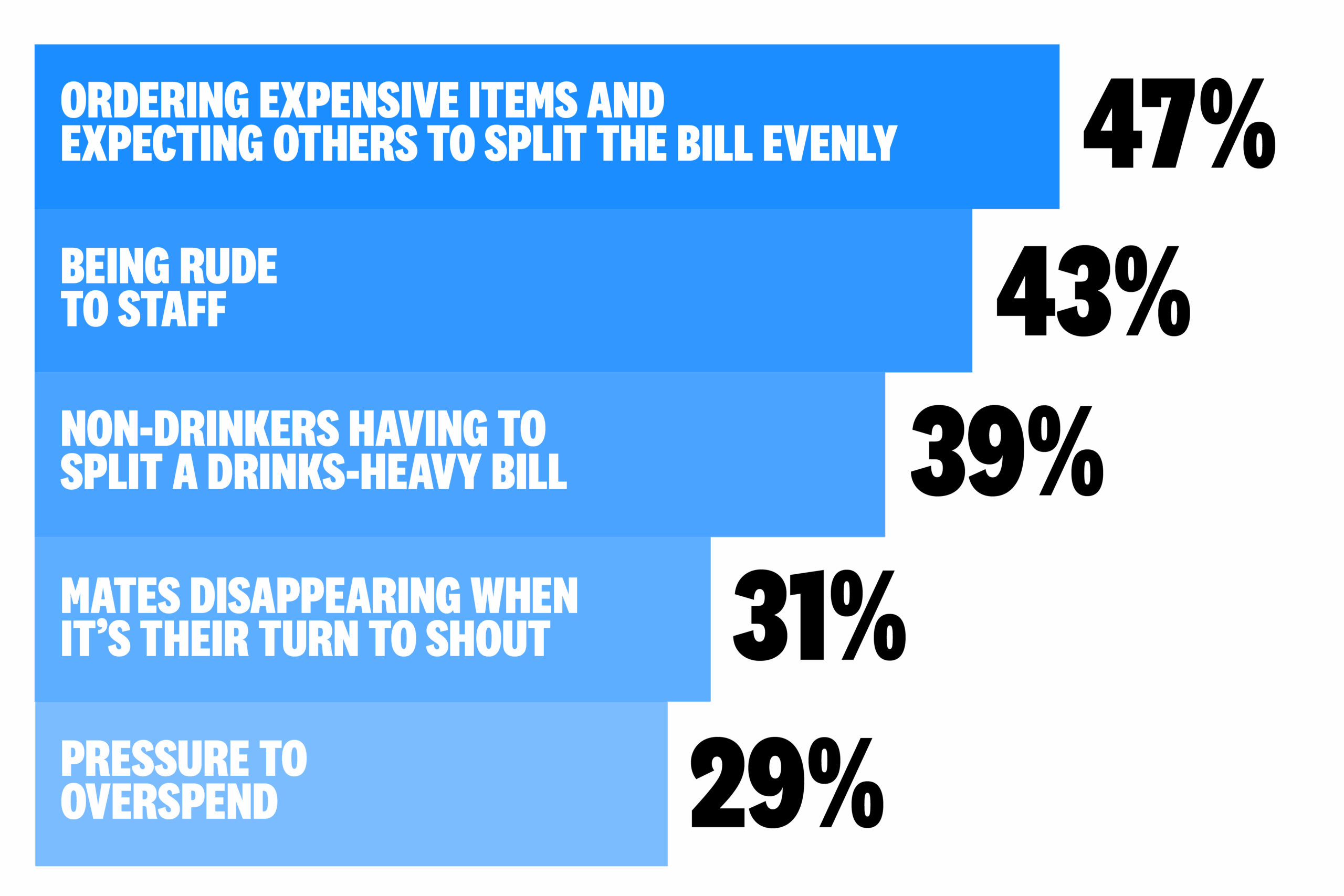

As hospitality spend becomes more discretionary, Australians are becoming more deliberate about how bills are split.

Half of Australians (50%) now prefer to pay only for their own order, rather than splitting the bill evenly (17%) or taking turns shouting (9%).

More than one in three (37%) Aussies use QR code ordering to avoid awkward money conversations with friends. Millennials are the biggest culprits, with 44% opting to use a QR code to avoid telling their mates they don’t want to shout a round.

These same pressures are leaving little room for discretionary extras like tipping. Nearly two thirds of Australians (65%) say they never tip when eating out or going to the pub, and a further one in ten (11%) say they are tipping less due to cost-of-living pressures. Tyro transaction data reinforces this, showing tipping is uncommon in practice, with just 1 in 100 restaurant transactions including a tip in December 2025. This reflects the reality that tipping is not routinely expected or enabled at many venues, and remains far from a standard part of dining out in Australia.

Australians expect the price of everyday hospitality items to keep rising, particularly coffee and beer. Consumers expect the price of coffee to almost double over the next decade, reaching $6.70 by the end of 2026, climbing to $9.70 by 2030, and $13 by 2035.

A similar pattern is emerging for beer. Consumers expect a schooner to reach almost $10 by the end of 2026, rise to $13.70 by 2030, and reach $17.70 by 2035.

However, willingness to pay is already lagging behind expectations. The average maximum price Australians say they’re willing to pay for a coffee is $6.60. For a beer, the average ceiling is $9.80, meaning expected 2026 prices exceed what many Australians say they are willing to pay.

For many Australians, everyday hospitality is shifting from habitual to discretionary.

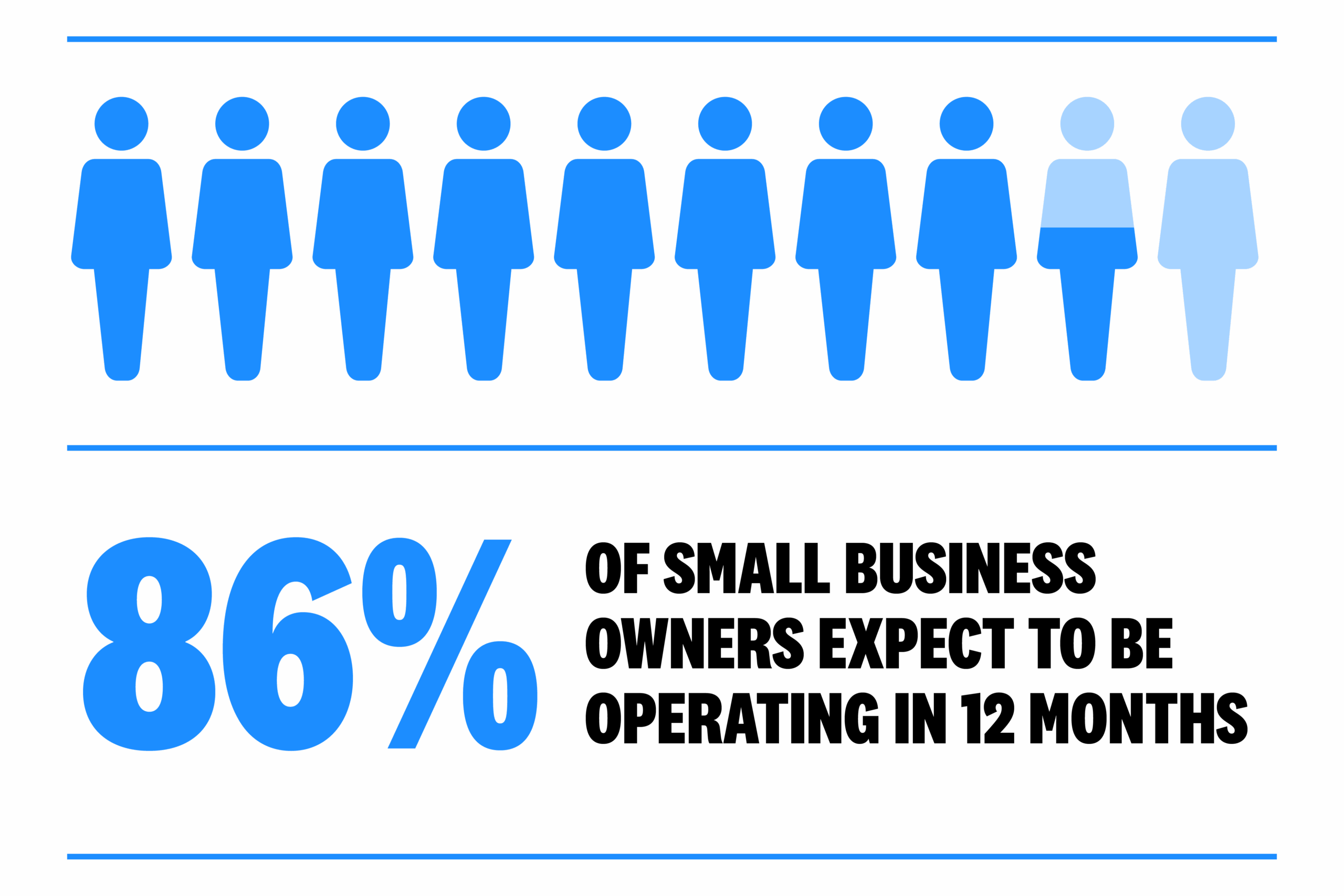

Small businesses continue to show strong confidence about the year ahead. More than four in five owners (86%) expect they will still be operating a year from now, reflecting a sector that remains resilient and committed to serving customers.

Across the hospitality industry, many operators are focusing on strengthening the fundamentals of their business and responding to how customers are choosing to spend. For some venues, this has meant leaning into food-led offerings, value-driven pricing, and creating consistent reasons for customers to keep coming back.

At The Oaks Hotel in Neutral Bay, owners say food-led demand has been a key driver of confidence. Strong food sales bring people through the doors regularly, which in turn supports bar sales and overall turnover.

– Andrew Thomas, Owner of The Oaks Hotel, Neutral Bay

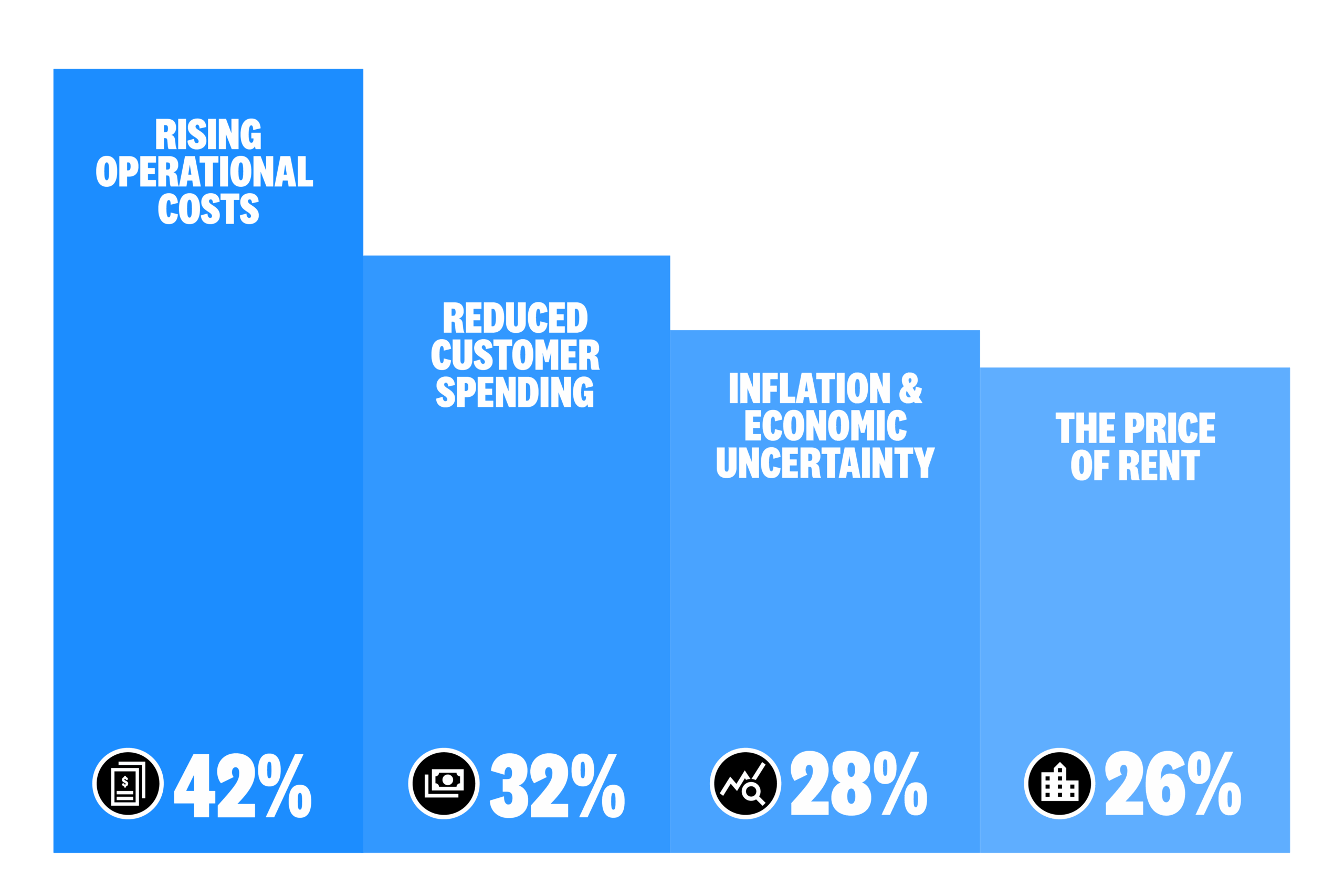

When asked what they are concerned about, more than four in ten owners (42%) say increasing costs are top of mind, closely followed by reduced customer spending (32%). Rent pressures also continue to weigh on one in four businesses.

Importantly, the challenge is not a lack of customers. Australians are still going out, but they are more considered in how they spend. Price sensitivity now shapes many day-to-day decisions, from what people order to how often they visit.

For venues, this means operating in a more deliberate environment. Costs are higher, while customers are making more thoughtful choices. Rather than signaling a drop in demand, this shift reflects a change in spending patterns, with businesses adapting their offer, pricing, and operations to meet customers where they are.

– Andrew Thomas, Owner of The Oaks Hotel, Neutral Bay

Pricing on weekends and public holidays remains a sensitive issue for consumers. Three in four (76%) Australians say they dislike paying higher prices on these days and one in three (31%) actively avoiding venues that charge more.

At the same time, transaction data shows just how important these trading periods are for hospitality businesses. Tyro data reveals hospitality spend is increasingly concentrated into weekends. In bars across Australia, weekends now generate 41% of total transaction value, despite representing just 29% of trading days.

These peak periods are also among the most expensive to operate due to higher labour costs. As trade becomes more concentrated into fewer, higher-cost days, the ability to adjust pricing plays an important role in whether venues can open their doors at all.

If public holiday pricing was removed, nearly one in three (31%) businesses say they would stop trading on weekends or public holidays, while almost one in ten (9%) say they would need to close entirely.

– Andrew Thomas, Owner of The Oaks Hotel, Neutral Bay

Female: 52%

Male: 48%

18-24 years: 9%

25-34 years: 18%

35-44 years: 18%

45-54 years: 17%

55-64 years: 16%

65+ years: 23%

Gen Z: 14%

Millennial: 31%

Gen X: 25%

Boomer: 27%

Silent Generation: 3%

NSW: 31%

VIC: 26%

QLD: 20%

WA: 11%

SA: 7%

TAS: 2%

ACT: 2%

NT: 1%

Female: 43%

Male: 57%

18-24 years: 6%

25-34 years: 18%

35-44 years: 25%

45-54 years: 17%

55-64 years: 20%

65+ years: 14%

Gen Z: 14%

Millennial: 34%

Gen X: 28%

Boomer: 23%

Silent Generation: 2%

NSW: 32%

VIC: 31%

QLD: 20%

WA: 8%

SA: 7%

TAS: 2%

ACT: 1%

NT: 0%

Eat Pay Love is an annual hospitality insights survey conducted by Tyro. 2,537 Australians were surveyed, consisting of 519 small business owners and 2,018 consumers via research agency Antenna. The survey was conducted nationally in December 2025, and respondents were sourced using an accredited online research access panel. Data was weighted for representation against the 2021 ABS Census.