Maximise small business revenue with digital payment solutions

EFTPOS is a common term in the world of commerce, but what exactly does it mean? Electronic funds transfer at point of sale, otherwise known as EFTPOS, is a technology that allows customers to pay for their products or service with a debit or credit card.

EFTPOS lets you accept electronic payments in your store, giving your customers more ways to pay.

As cash as a form of payment acceptance continues to decline in Australia¹, EFTPOS is a crucial business service that customers have come to expect. It’s just one of the reasons why you need an EFTPOS solution for your business.

EFTPOS technology emerged in the United States during the early 1980s.²

Introduced to the Australian market four years later, in 1984, EFTPOS made speedy and secure card payments at the cash register possible for the first time.³

This payment method revolutionised the Australian consumer market – so much so that in 2016, card usage surpassed cash usage for the first time ever; that year, 52 per cent of payments were made using debit or credit cards.4

Now that you know what EFTPOS is, you’re probably wondering how EFTPOS works.

The foundation of this payment system is an EFTPOS machine. This electronic device does all the heavy lifting – reading cards and moving money along – to make transactions happen.

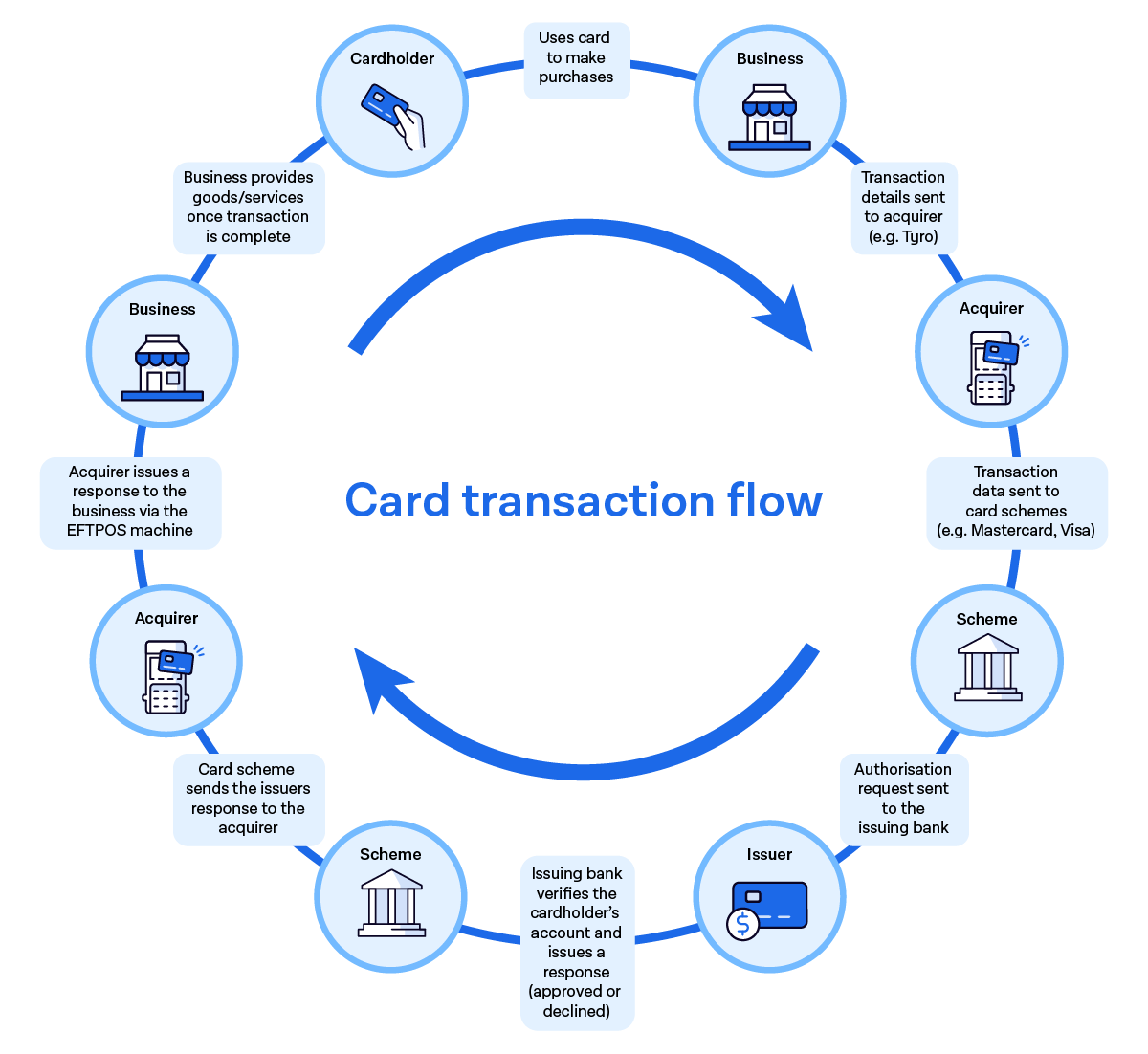

When a customer inserts, swipes, or taps their card on an EFTPOS machine, their payment request is sent to the business’ acquiring bank, for example, Tyro. Almost instantly, we send a request to the cardholder’s bank to make sure funds are available and that everything looks legitimate. If everything is in order, the green light is given. A hold is then placed on the funds and the funds are moved from the issuing bank to the acquiring bank. The acquiring bank then settles the total funds into the business’ bank account, completing the transaction. This process is all done securely, using encrypted data, to keep information safe and secure.

As we’ve mentioned, EFTPOS machines accept both debit and credit cards. While these cards typically look identical, they both work very differently.

A debit card is the most basic form of payment card that is generally linked to your everyday bank account. It uses the money you already have, instead of money you don’t.

A credit card lets you borrow funds from your bank to purchase goods and services, and pay them back, subject to each card’s conditions.

The biggest difference between debit and credit cards is that debit cards don’t usually incur fees, while credit cards usually do.

Tap and go is a modern advancement of electronic funds transfer technology.

Also known as contactless payments, tap and go lets customers hover their card over an EFTPOS machine to make a transaction – no inserting or swiping needed.

All of Tyro’s EFTPOS machines accept Tap & Go payments, keeping things convenient.

It costs money to process card payments. As a business, the fees and charges you have to fork out will vary depending on the card being used.

Tyro Tap & Save5 is a great feature that offers your business least-cost routing to automatically find lower cost ways for you to process eligible Tap & Go debit card transactions through the cheapest network. With Tyro’s Dynamic Surcharging6, you can also automatically apply your configured surcharge so you can recover some or most costs of accepting card payments easily.

Both debit cards and credit cards can be used to purchase goods and services over the internet, via eCommerce. This makes them multi-functional, working with payment systems both in-store and online.

Paying by EFTPOS is simple.

All customers have to do is pull out their physical plastic card, or a digital version of it on their mobile phone, or wearable device, and use it on an EFTPOS machine.

EFTPOS machines can live on the countertop or be brought to consumers wherever they are with mobile options now on the market.

When customers make a payment from their cheque or savings account, this travels through Australia’s debit card payment system, eftpos. When credit is selected, this payment could go through a variety of networks including Visa, Mastercard®, American Express, and JCB (these are all called schemes).

Other payments like Apple Pay, Google Pay™, and Samsung Pay, which are used for mobile devices or wearables, operate differently. These are all routed via one of the schemes, depending on the cards that are loaded in the digital wallets.

As we mentioned earlier, offering up an EFTPOS solution to your customers is critical to your business (customers just won’t come if they can’t pay the way they want to).

There are many types of EFTPOS solutions up for grabs, to suit the unique needs of your business.

Let’s go through Tyro’s EFTPOS solutions, so you can work out which one might work for you.

Tyro offers a range of EFTPOS solutions designed to meet the needs of various types of businesses. Whether you run a small cafe, a bustling retail store, a mobile business, or something in between, Tyro has an EFTPOS solution tailored to your requirements.

Tyro Pro is a sleek and modern EFTPOS machine tailored to the needs of medium to larger sized businesses, especially those in the hospitality, retail, or service industries. Tyro Pro offers versatility to accommodate various business models. The large 6-inch touchscreen and intuitive user interface not only facilitate quick and efficient transactions but also enhance the overall customer experience.

Not only does it have a sleek design, but Tyro Pro also comes with cutting-edge technology and all-day battery to support your business operations. It offers seamless POS integration, eliminating manual data entry and enhancing overall business efficiency.

Tyro Pro offers dual connectivity via WiFi, Ethernet, and mobile network backup, reducing business interruptions. Monitor your operations effortlessly with the Tyro App, Tyro Portal, or real-time reporting on your device—all for free!

Additionally, Tyro Pro offers features designed to help your business save on card transaction fees, including Tyro Tap & Save5 and Dynamic Surcharging6. Learn more about these features in our blog – 3 strategies for reducing card transaction fees.

Tyro Go is a portable payments solution that allows you to take payments wherever your business takes you7. Small and lightweight, you can slip Tyro Go into your pocket, bag, toolbelt (or wherever you need it), ready to whip out when you need it.

Tyro Go comes with a free Tyro Go App that can be downloaded to your iOS or Android smart device. Tyro Go connects wirelessly to the Tyro Go App via Bluetooth so you can take payments from the palm of your hand. Tyro Go accepts Visa, Mastercard®, eftpos, American Express, JCB, as well as digital wallets like Apple Pay, Google Pay, and Samsung Pay. Additionally, Tyro Go allows you to produce paperless e-receipts that are sent directly to your customer’s email address – no printing needed.

Tap to Pay on iPhone with the Tyro BYO App8 allows you to accept in-person payments anytime, anywhere using just your iPhone, without the need for any extra hardware9. With only an iPhone and the Tyro BYO App, you have everything required to accept a wide range of contactless payments on the spot. This includes physical debit and credit cards, as well as popular digital wallets such as Apple Pay, Samsung Pay, and Google Pay.

Experience the peace of mind that comes with secure and private transactions when using Tap to Pay on iPhone10. This solution leverages the built-in features of the iPhone to ensure the privacy and security of your transaction data10.

Getting started with Tap to Pay on iPhone and the Tyro BYO App is straightforward; simply download the Tyro BYO App, apply, and you’ll only incur charges when you start accepting payments. It’s a hassle-free way to accept payments with ease and confidence.

Depending on the EFTPOS solution you opt for, you’ll need to have certain features at the ready to integrate it into your business. These can include:

From here, it’s a matter of following the instructions to hook everything up.

Tyro makes it easy to find, install and start using an EFTPOS solution that suits your business. Get in touch with us to set one up, no fuss.

As a business, being able to do electronic funds transfers is essential.

Fast, integrated payment systems like Tyro EFTPOS make it easy to take advantage of the thousands of customers who prefer the convenience of card payments, helping you keep those customers coming.

Want to take your business further with Tyro? Get in touch!

1 Reserve Bank of Australia. (2020). Consumer Payment Behaviour in Australia. https://www.rba.gov.au/publications/bulletin/2020/mar/consumer-payment-behaviour-in-australia.htm

2 Techopedia. (n.d). Electronic Funds Transfer at Point of Sale (EFTPOS). https://www.techopedia.com/definition/1498/electronic-funds-transfer-at-point-of-sale-eftpos

3 eftpos. (n.d.). About eftpos. https://www.eftposaustralia.com.au/about/our-company

4 Reserve Bank of Australia. (2016). How Australians Pay: New Survey Evidence https://www.rba.gov.au/publications/bulletin/2017/mar/pdf/bu-0317-7-how-australians-pay-new-survey-evidence.pdf

5 Tyro does not guarantee any cost savings by opting in for Tap & Save. Savings on eligible transactions processed through the cheapest network vary for each business depending on their card mix, transaction volume and amount, industry, and pricing plan. Eligible transactions are contactless debit card transactions less than $1,000. Tap & Save is not available on Special Offer pricing, Card Not-Present Transactions or where you surcharge on debit card transactions as cost savings may not be realised. For details refer to Tyro.com or call 1300 00 TYRO (8976).

6 Dynamic Surcharging is available for Mastercard, Visa, eftpos, UnionPay, American Express, JCB, and Diners Club on CounterTop, Mobile and Tyro Pro EFTPOS machines, and excludes eCommerce transactions. By default, we do not include your EFTPOS machine rental costs into the calculation of your cost of acceptance, however you may choose to apply these costs into your calculation of your cost of acceptance via the Tyro Portal subject to the surcharging rules as set by the RBA and enforced by ACCC.

7 Tyro Go EFTPOS reader requires a Bluetooth-enabled mobile device or tablet, the Tyro Go App to be installed, and mobile network coverage. Check Google Play & App Store for the latest OS compatibility requirements.

8 Tap to Pay on iPhone requires iPhone Xs or later running iOS 16.4 or later via the Tyro BYO App. Some contactless cards may not be accepted by the Tyro BYO App. The Contactless Symbol is a trademark owned by and used with permission of EMVCo, LLC. For more details, see https://developer.apple.com/tap-to-pay/. The Tyro BYO App requires mobile connectivity for use.

9 Businesses are required to use their own iPhone. Tyro BYO App is free to download via the App Store.

10 Tap to Pay on iPhone uses the in-built features of iPhone to keep your business and customer data private and secure. Apple doesn’t store card numbers on the device or on Apple servers.

11 Medicare Easyclaim is only available where your third-party software or practice management system supports the integration.

12 Tyro HealthPoint claiming via your Tyro EFTPOS machine is only available where your third-party software or practice management system supports the integration, including Medipass.

Apple, the Apple logo, Apple Pay and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries and regions. App Store is a service mark of Apple Inc., registered in the U.S. and other countries and regions.

Google Pay is a trademark of Google LLC.

Mastercard is a registered trademark of Mastercard International Incorporated.

You may also like

4 Jul 2024 - 4 min read

2 Jul 2024 - 7 min read

6 May 2024 - 7 min read

25 Mar 2024 - 6 min read

Australian-based 24/7 support