Fast, flexible business loans

When cashflow gets tight, the Tyro Flexi Loan can help eligible Tyro customers bridge the gap — with a fast, streamlined process and no lengthy paperwork *.

Tyro customers only. Lending criteria apply.

When cashflow gets tight, the Tyro Flexi Loan can help eligible Tyro customers bridge the gap — with a fast, streamlined process and no lengthy paperwork *.

Tyro customers only. Lending criteria apply.

Access funds in as little as 60 seconds and just a few clicks *.

No interest rate, just one simple fixed fee. You’ll know exactly what your loan costs upfront.

Nominate a percentage of your daily takings to repay. Payments rise and fall with your sales.

Manage everything in the Tyro Bank App or Portal.

Need new equipment or stock before the financial year ends? Don’t let cash flow hold you back. Score a cashback bonus and make your EOFY purchases count when you fund up to $350,000 * with your first Tyro loan by 30 June 2026.

New Tyro loan customers only. Approval required. Funding time may vary. Cashback paid after loan repaid in full. Loan costs refers to the Loan Fee. 100% cashback applies to loans up to $5,000. T&Cs apply

Tyro customers can borrow unsecured amounts up to $350,000 *

Log in to your Tyro Bank App or Portal to see your conditionally eligible loan amount – calculated instantly.

Review your offer, accept the terms, and get funds transferred within as little as 60 seconds *.

Choose a repayment percentage that suits your business. Payments automatically adjust with your daily takings.

View your loan balance, track repayments, and pay down early from the Tyro Bank App or Portal.

Designed for businesses who feel the daily pinch of managing cash flow. Perfect when you need to:

> Cover payroll during slower trading months

> Pay a large supplier

> Replace or repair equipment quickly

> Stock up ahead of a busy season

> Bridge cashflow gaps while waiting on invoices

> Fund new projects, open additional locations, or enter new markets

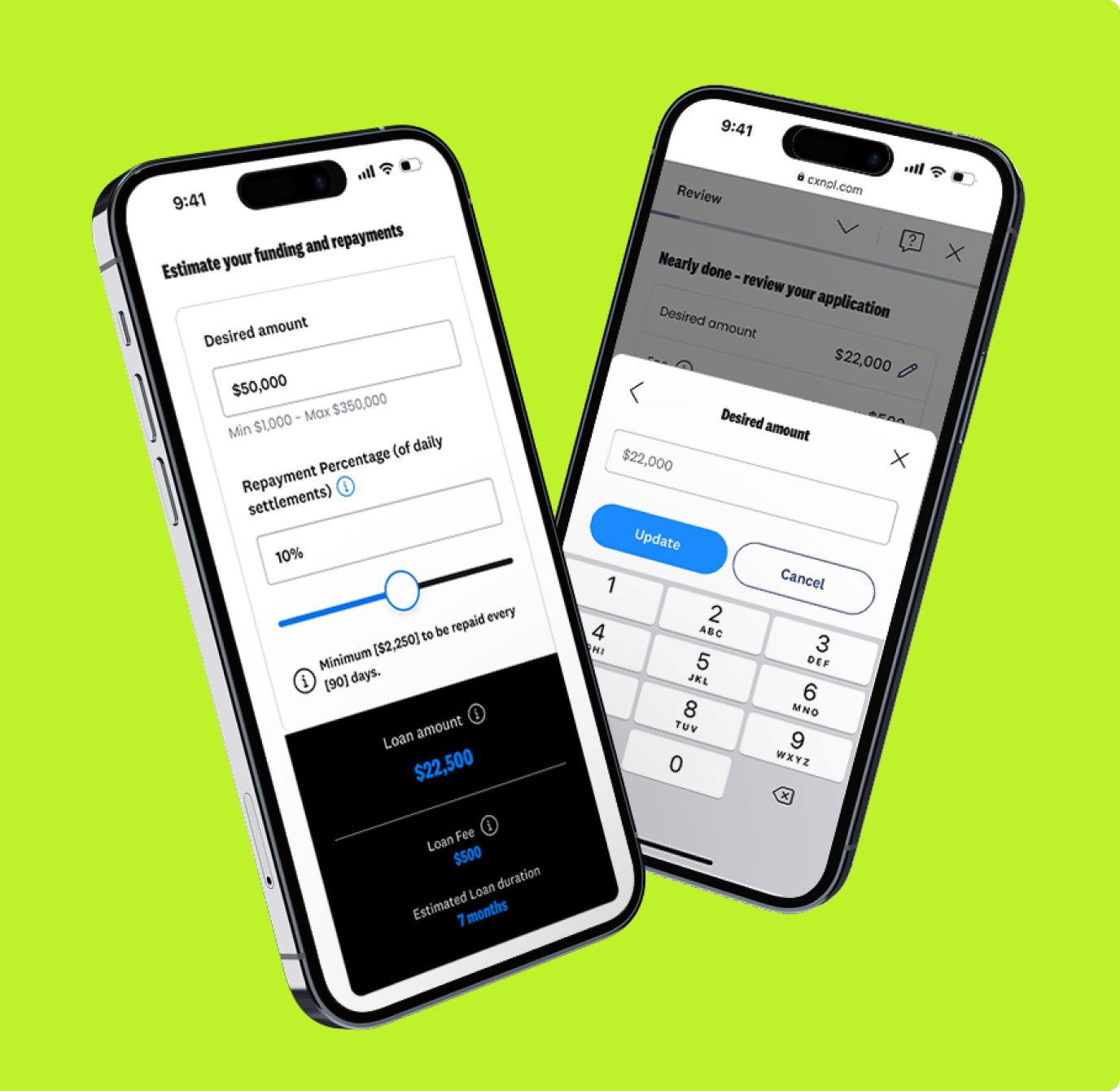

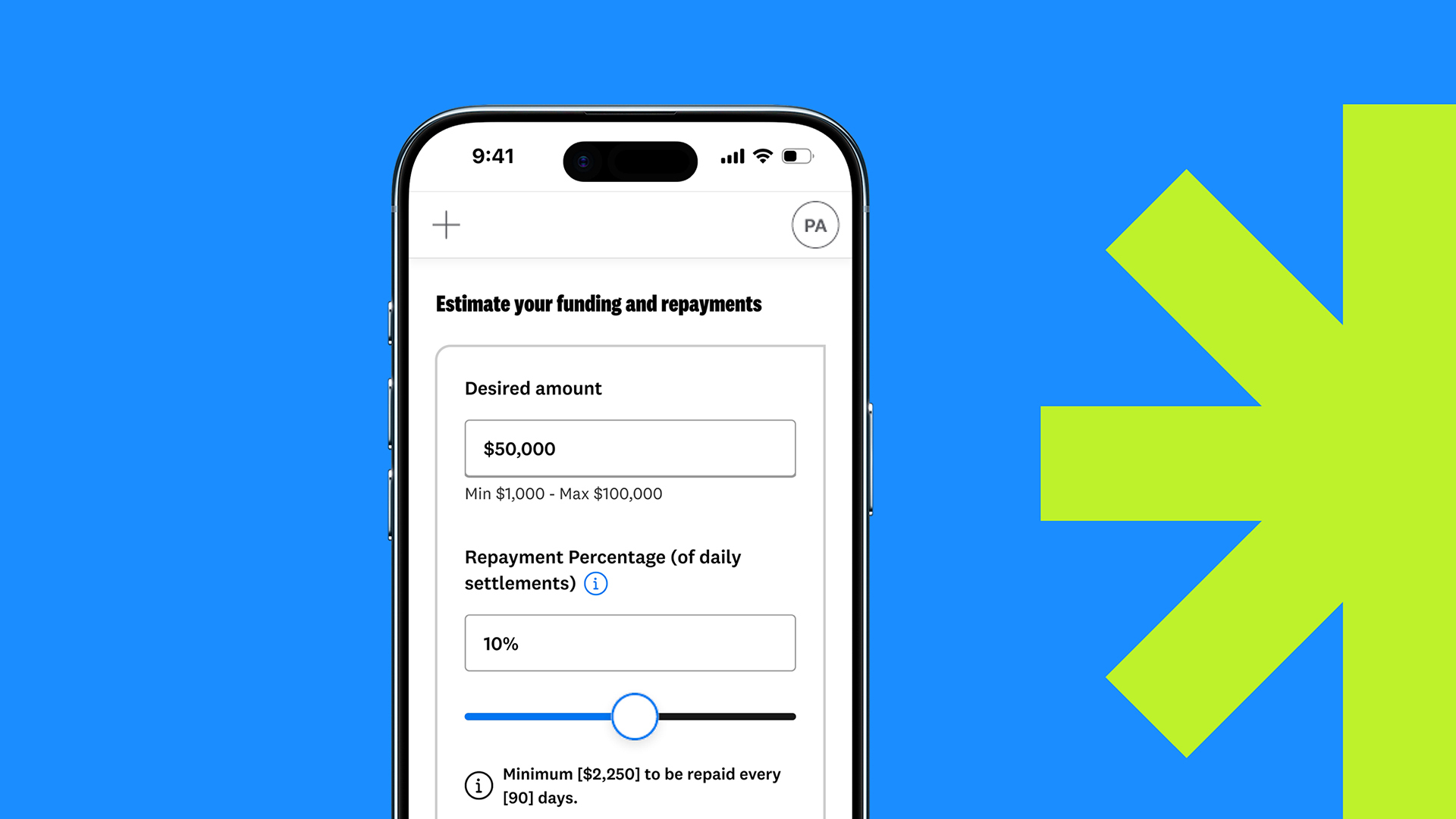

Find out how much you could borrow and understand your repayment costs. Use our tool to see the fee structure and how it aligns with your transactions.

Via Tyro Bank App or Portal (or skip this step if you already have one)

Go to Tyro Flexi Loan via the Banking section in the Tyro Bank App or Portal

Select the amount you want to borrow and nominate the percentage of your daily takings to repay your loan

Review the simple fixed fee and confirm

Typically deposited into your Tyro Transaction Account within as little 60 seconds *

*There may be some scenarios where Tyro will need to gather additional information about your business before we can determine your eligibility.

When comparing unsecured loans, it’s important to look at factors like loan amounts, repayment terms, and flexibility. You should also consider the loan fee structure instead of traditional interest rates, along with how repayments align with your cash flow. By comparing these factors, you can find a loan that suits your business’s financial situation. With Tyro, you can explore different loan options to determine what your repayments would be through the Tyro Bank App and tailor the loan to meet your needs.

Yes, A Tyro Transaction Account is required to apply for and access a Tyro Flexi Loan from the Tyro Bank App and Tyro Portal. Additionally, Tyro customers without a Tyro Transaction Account won’t be able to access the banking section of the Tyro Portal.

Eligible Tyro customers that don’t have a Tyro Transaction AccountBank Account will be prompted to open one as part of the loan application process. If you aren’t prompted to open a Tyro Tyro Transaction AccountBank Account, please contact our Customer Support team on 1300 00 TYRO (8976) for more information on what’s required.

The approval process is quick, often completed within minutes if you’re already a Tyro customer. Funds can be deposited into your Tyro Transaction Account in as little as less than 60 seconds. In some instances, we may require more information to complete your eligibility check.

Unsecured business loans can be used for a variety of expenses, including:

● Inventory Purchases: Acquire new stock or replenish existing inventory.

● Equipment Upgrades: Invest in new technology or machinery to enhance operations.

● Staff Expansion: Hire additional employees or fund training programs.

● Operational Costs: Cover day-to-day expenses and manage cash flow.

● Business Expansion: Fund new projects, open additional locations, or enter new markets.

We make repayments simple. Just nominate a percentage of your daily takings to go towards your loan repayments so you repay as you trade. This means repayments rise and fall in line with your cash flow so you have flexibility during slower periods (subject to minimum repayments). You also have the option to make manual payments and even pay the loan in full anytime, but you should note that the loan fee will remain the same.

Instead of an interest rate you are charged a loan fee, which is paid down with your loan repayments over the life of the loan. You can use the loan calculator in the Tyro Bank App or Tyro Portal to explore how much you can borrow, customise your repayment options and calculate your loan fee so you know how much your loan will cost up front.

The loan is flexible when you want to pay it off faster; that’s up to you. The loan fee is payable regardless of how quickly you pay off the loan. To pay off your loan sooner with a lump sum repayment, you can do this in the Tyro Bank App, or simply contact Tyro Customer Support on 1300 00 8976.