How can we help?

With your choice of competitive interest rates.

Choose from 30, 60, 90, 180, and 365 day terms.

Deposits up to $250,000 are protected under the Australian Financial Claims Scheme *.

Maximise your guaranteed returns with zero ongoing fees.

A business term deposit is a smart way to grow your savings safely and lock in a guaranteed interest rate at the same time.

Whether you’re a restaurant managing regular supplier payments, a retail store preparing for inventory restocking, or a mechanic setting aside funds for new machinery, a business term deposit can help you plan for upcoming expenses by aligning your funds with your cash flow cycle.

With term options that suit your business needs, it’s a simple way to make your savings work smarter.

Whether you’re planning for the short term, or thinking further ahead, choose the term that fits your business needs and enjoy the competitive interest rate that comes with it.

Rates are exclusive for Tyro customers. Interest is paid at account maturity ^.

30 Days

60 Days

90 Days

180 Days

365 Days

Rates are current as 8 September 2025 and subject to change.

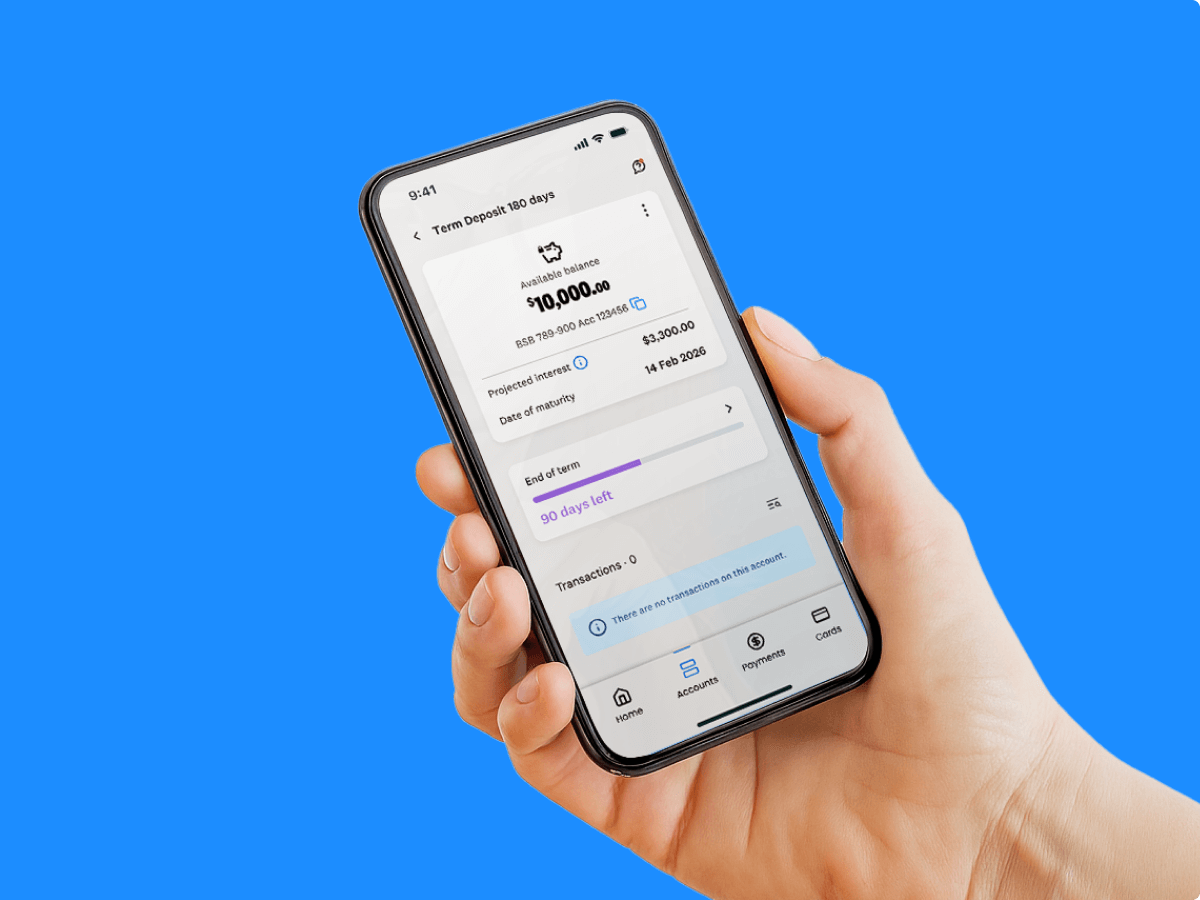

On the maturity date, the initial principal amount invested plus the interest you have earned during the term of your Tyro Business Term Deposit will be transferred to your Tyro Transaction Account.

Through the Tyro Bank App

Step 1 – Download the Tyro Bank App

Step 2 – Click on the ‘Accounts’ tab

Step 3 – Click ‘New’

Step 4 – Follow the prompts to accept the Terms & Conditions

Through the Tyro Portal

Step 1 – Log on to the Tyro Portal

Step 2 – Click on the ‘Products’ tab

Step 3 – Find ‘Term Deposit’ and click ‘Open now’

Step 4 – Follow the prompts to accept the Terms & Conditions

To open a Tyro Business Term Deposit, you will need an active Tyro Transaction Account.

You can invest a minimum principal amount of $1,000 AUD per term deposit account.

You can invest a maximum principal amount of $1,000,000 AUD per term deposit account.

Tyro has its own banking licence, which means your deposits with Tyro are guaranteed under the Financial Claims Scheme up to $250,000 per account holder. For more information visit ASIC’s MoneySmart website or APRA’s Financial Claims Scheme website.