Tyro & Xero

Make running your business easier by integrating the Tyro Bank Account with Xero.

Make running your business easier by integrating the Tyro Bank Account with Xero.

By linking your Xero Accounting software to the Tyro business bank account you get access to integrated bank feeds providing seamless reconciliation.

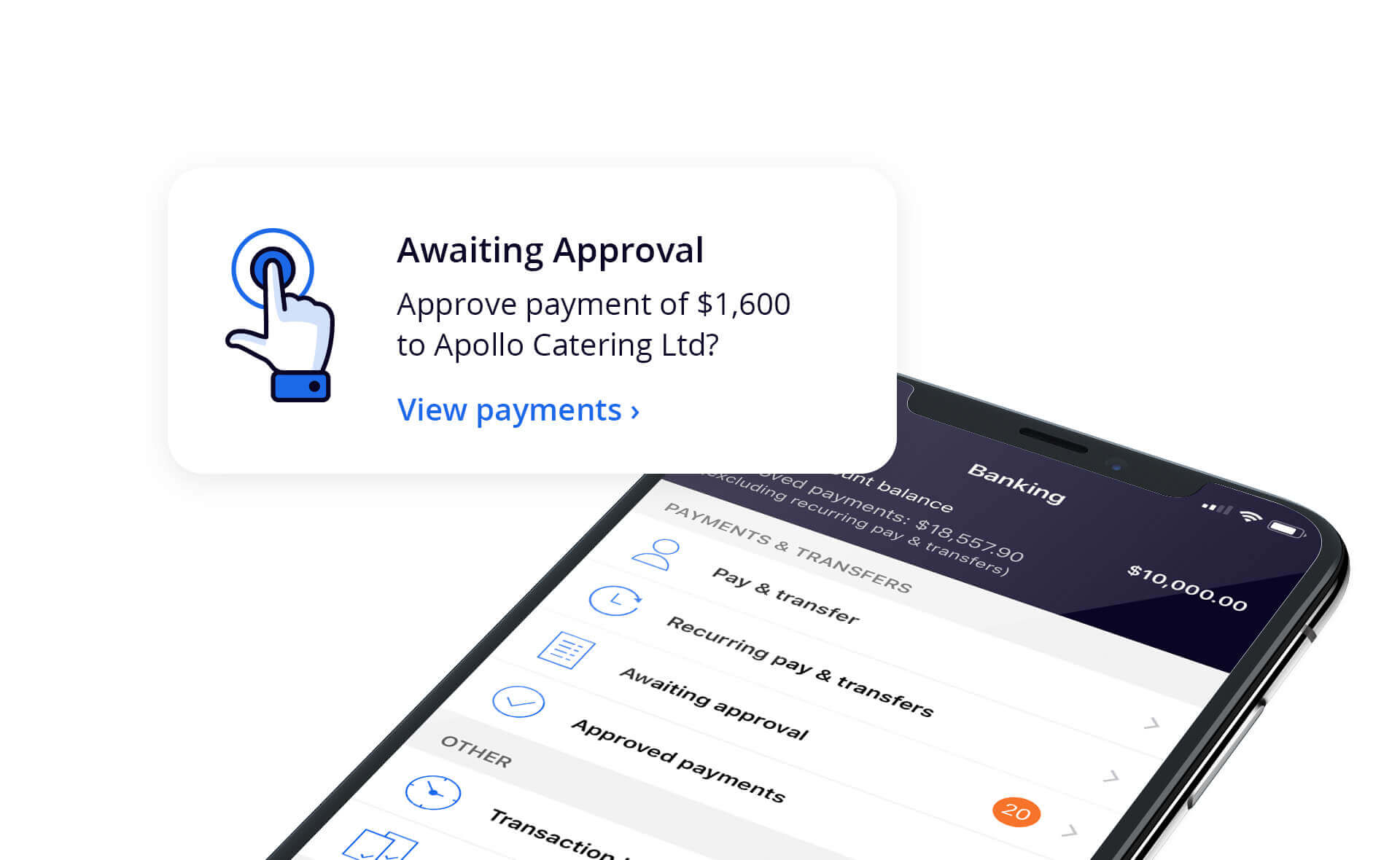

You can also schedule batch payments in Xero – including BPAY® and bank transfers, and your Xero Payroll. This can all be approved in the Tyro App with the simple click of a button eliminating double entry of your payments and payroll and saving you time.

Get our fast, integrated and secure EFTPOS. Your EFTPOS and eCommerce takings will be deposited into a fee-free, interest-bearing Tyro Bank Account at a time you choose 1.

Select the Xero Connection notification on the home screen of your Tyro App to link and authorise your Xero account.

Streamline payments with one single settlement and accept payments fast and securely in-store and/or online.

Keep cash flow moving. Borrow unsecured amounts up to $350,000 and make payments that work for your cash flow 2.

The right EFTPOS option can make a real difference to your business.

Tyro EFTPOS is packed with features that make it easy to use and better for business.