How can we help?

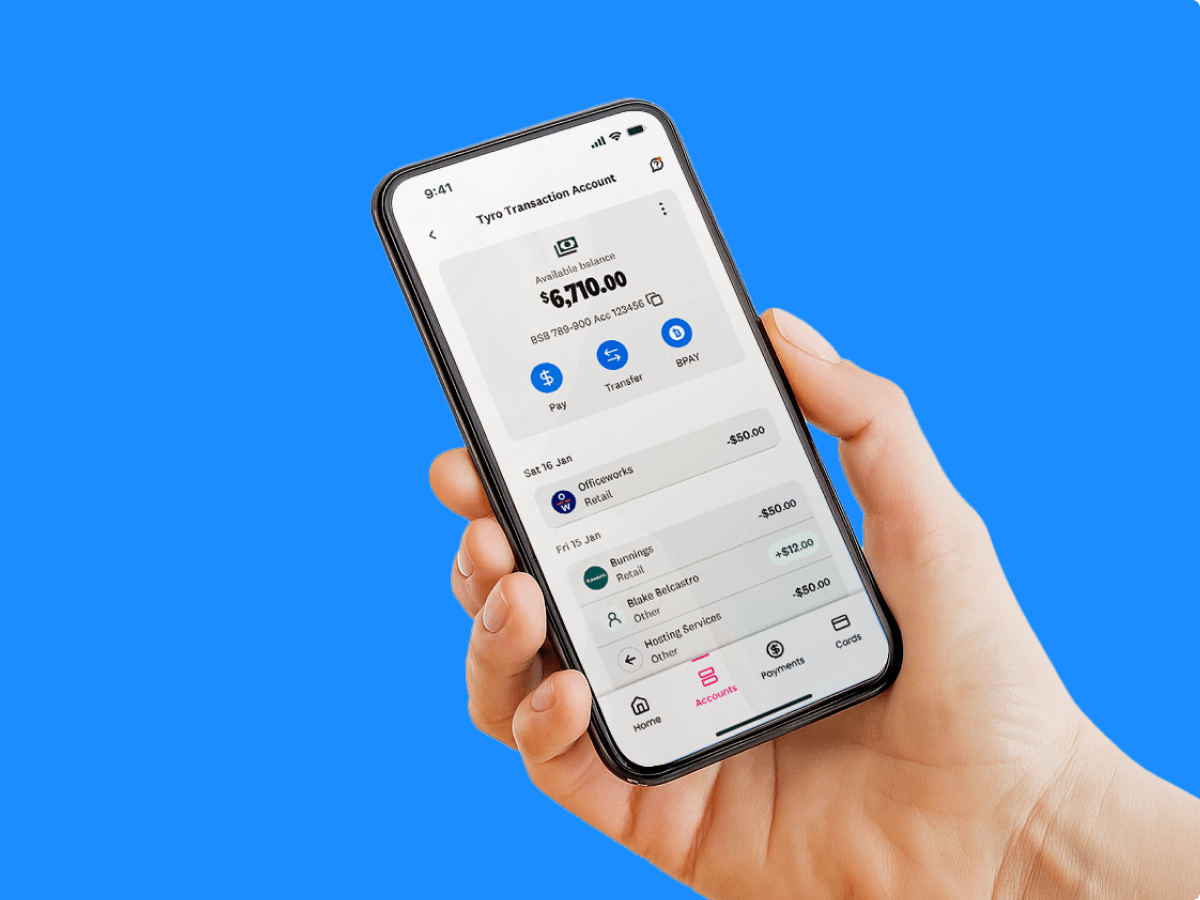

Same day settlement and effortless cash flow from the moment you accept a payment *.

Grow your business savings at a competitive fixed interest rate ^.

Access funds in as little as 60 seconds and just a few clicks §.

Manage your banking, transactions and Term Deposits – all in one place

With same day settlement *, 7 days a week, including weekends and public holidays

No account-keeping or set up fees, with no minimum balance required

Choose from direct debit, PayID®, PayTo®, Osko®, BPAY®, bank transfer to cover business expenses fast and securely

Manage your cash flow, track spending, and allocate funds for different purposes

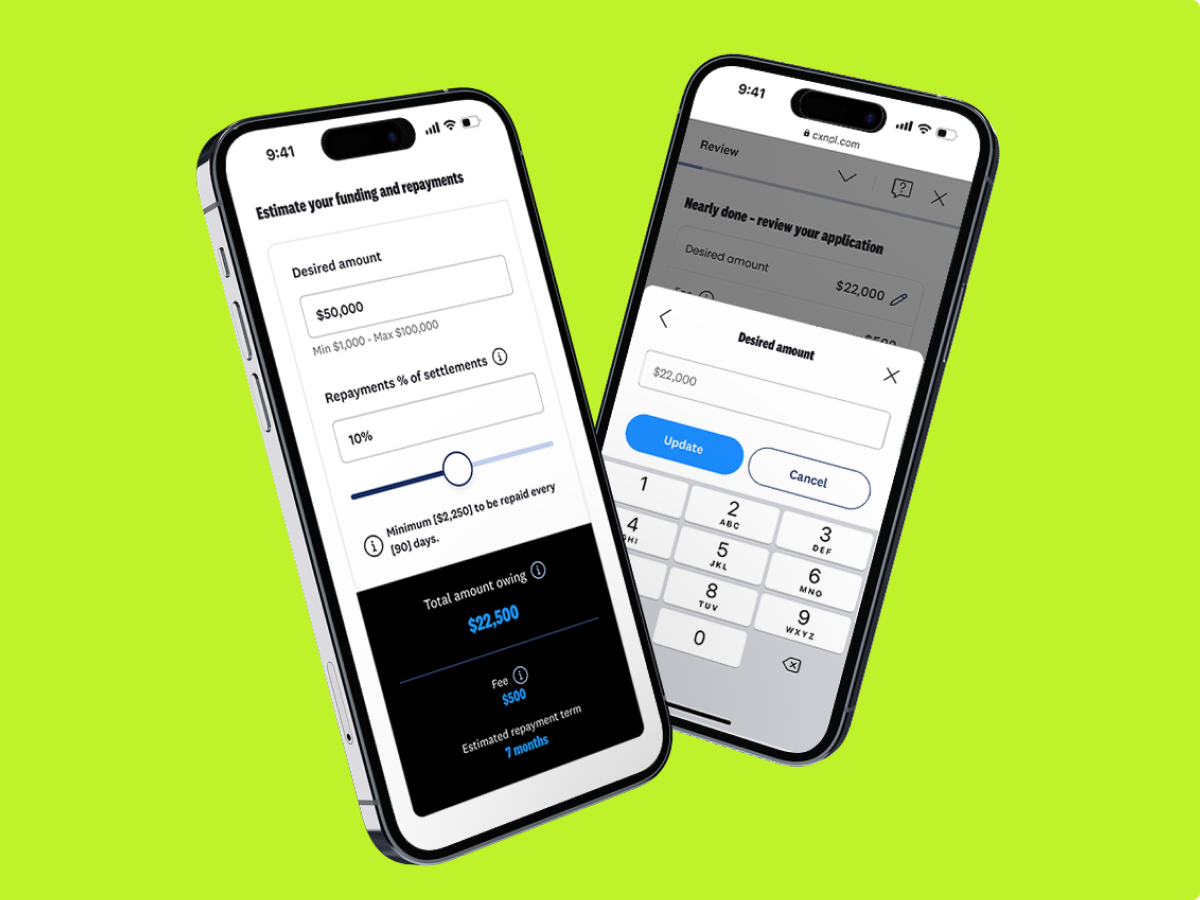

Flexible funding when you need it.

> Super-fast funds

Access funds in as little as 60 seconds and just a few clicks §.

> Manage it all in one place

View your loan balance, track repayments, and pay down early from the Tyro Bank App or Portal.

> Flexible repayments

Nominate a percentage of your daily takings to repay. Payments rise and fall with your sales.

Access your money easily with a Tyro Visa Debit Card. Withdraw your funds, or make payments online, in-store, or over the phone.

> No wallet? No problem

With Apple Pay, you can pay with your Tyro Visa Debit Card directly from your iPhone® or Apple Watch® anywhere that accepts contactless payments.

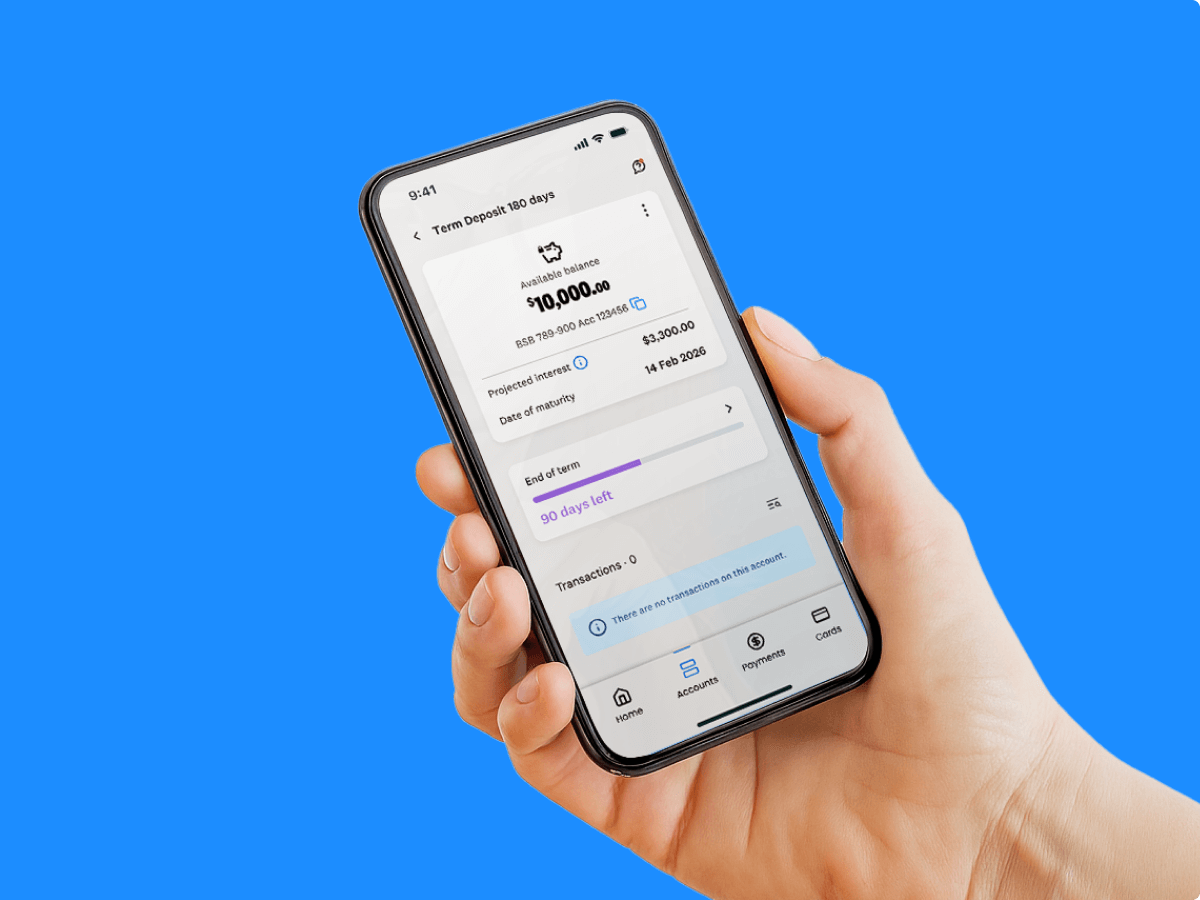

Get guaranteed returns with a Tyro Business Term Deposit δ. Lock in an awesome fixed interest rate at a term that fits your business’s needs and make your money work harder for you.

> Grow your savings faster

With your choice of competitive interest rates

> A term to fit your plans

Choose from 30, 60, 90, 180 and 365 day terms

> No monthly or account keeping fees

Maximise your guaranteed returns with zero ongoing fees

> Open a Term Deposit in minutes

Easy to set up in the Tyro Bank App

Connect your Tyro Transaction Account to Xero® or MYOB® through the Tyro Portal to make bookkeeping effortless.

> Your daily deposits, withdrawals and payments flow straight into Xero or MYOB – no uploads or data entry needed.

> Saving time, reducing errors, and keeping your finances effortlessly organised.

The Tyro Transaction Account is available exclusively to new Tyro EFTPOS and eCommerce merchants. To be eligible, new to Tyro customers who wish to take up a Tyro Transaction Account should opt in during their onboarding process.

You can opt-in during your sign-up application.

Access your Tyro Transaction Account, Term Deposits and more through the Tyro Bank App or Tyro Portal.

See how businesses use Tyro to help run and grow their business.

Customers new to Tyro can open a Tyro Transaction Account by applying online during onboarding. Eligible existing Tyro merchants who have not previously held a Tyro banking product can now apply for a Tyro Transaction Account directly through the Tyro App or Portal.

Yes, you need a Tyro Transaction Account to access fixed term deposits.

Log into the Tyro Portal or Tyro Bank App to manage your business banking with Tyro anytime, anywhere.

Tyro’s online business banking, uses industry standard encryption and multiple layers of security to protect your financial data. Our systems are designed to provide a safe and reliable banking experience for your business. The Tyro Transaction Account has 24/7 fraud monitoring, detection and intervention.

Plus, your deposits are protected under the Financial Claims Scheme up to $250,000 per account holder.